I have had a number of clients ask me if we are still doing property tax protests, as they had received a handful of pieces in the mail from our competitors encouraging them to protest your property taxes, but not one from our firm.

2011 Status

Our office has only recently resolved our property taxes cases for 2011. The conclusion of these cases makes for the first time in 3 years that one year was complete before the next year started. During those 3 years we have protested over $745,000,000 in values, so from our perspective it certainly feels like most of the commercial and apartment buildings that could be protested have been done.

2012 protests

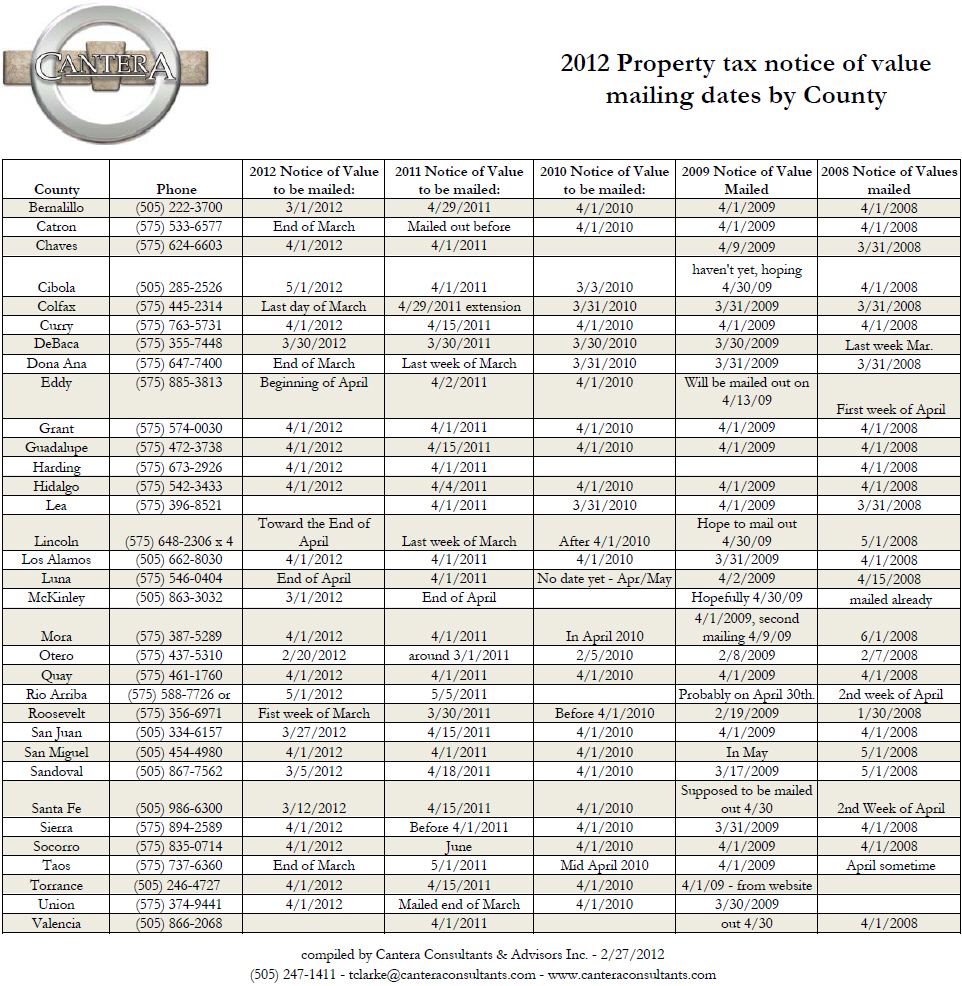

Although I am always glad to review your properties, for the most part I am recommending to my clients that they not protest their values this year. WHY you might ask? It’s simple, according to our value survey (attached), the market has started to turn the corner, and after 3 solid years of being able to lower our client’s property’s values, we think that window of time is drawing to a close.

Is there a downside to protest your property taxes every year?

Yes, when you file a protest, you open the door to an increase in value. If in reviewing your property’s info the assessor find cause to believe your property is under assessed, the can request an increase in value, and although I’ve never had it happen to me, I’ve had many assessors threaten to raise values, particularly when they feel a property owner filed a frivolous protest.

Material change in property in 2010 or 2011

I think the exception to this would be if your property has experienced a substantial physical or occupancy change in 2010 or 2011.

2013 is a reappraisal year

Although state law requires each county to reappraise its portfolio of properties every two years, many counties have gone for long periods of time with minimal increases in value.

Santa Fe County has announced that it has expanded its budget to bring all of the commercial properties to current and correct. My understanding is that Sandoval county is staffing up with the intent of revaluing all commercial properties, and Bernalillo County has indicated a similar effort.

Property Tax Lightning

As you may recall, the property tax lightning battle that is entering its fourth year, has been previously won a formal board level as well as district court, but those decisions have been appealed to the appellate court, which has not provided a ruling.

Apartment Tax Lightning

The back story for apartment tax lightning is a bit convoluted and long – so rather than bore you with the details, I can tell you that apartment owners continue to prevail in these cases – a summary of our 2011 cases can be found here – http://www.toddclarke.net/?p=1464 as well as the 2010 cases here- http://www.toddclarke.net/?p=969.

Class

If you would like to learn how our property tax system works, how to protest your own properties, or just need CE credit – our next course will be May 24th, 2012 – registration at www.canteraconsultants.com/registration

Textbook

If you don’t have time for the class, but would like the knowledge, we offer a 365 page textbook in both physical ($59 ) and digital form ($49 ). You can order your book online at www.canteraconsultants.com/bookk

App

If you are curious as to your property’s value or if you ever need to look up your property taxes from your iPhone or iPad – consider our $0.99 app – which can be found online at http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 . The Taxessor App takes the values from resolved cases and matches them up to your property to give you an indication of whether it might be possible to obtain a reduction.

Resource to look up your property’s historical values

Finally, If you need to look up more than years history at a time and you are tired of multiple

“clicks” and screens on bernco.gov – try out website – www.nmapartment.com – (scroll down and look in the left hand margin for the “Lookup your property taxes” – once you enter your UPC # and go – it will pull up a 10 year history of notices of values, and tax bills all on one screen.

As always, if you need anything related to property taxes in New Mexico, don’t hesitate to email or call me

Thanks,

Todd Clarke CCIM

CEO

Cantera Consultants & Advisors Inc.