I think of our property tax system as a bit of a prisoner’s dilemma (that is the game theory where two suspects are picked up by the police – if they both refuse to cooperate they walk, if either turns on the other suspect, then other suspect goes to jail, and if they both turn in the other, they both go to jail). Applying that to our property tax system, I believe that most property owners want a fair system, but so long as there are loopholes or the perception of unfairness, than they too want that loop hole – the end game of which is a downward spiral in tax revenues.

Personally, I believe in supporting the person who has the right ideas over a party ideology– and former Governor King is just such a person – in the early 1970s he had the state constitution rewritten, in part to deal with the inequities in the property tax system (it was common for your political affiliation to dictate how high or low your property taxes are). So whenever I contemplate changes to the property tax law, I think, what would Gov. King look for that would create a fair equitable system.

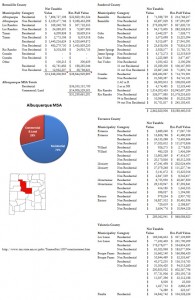

Although our property tax system has a lot of “fairness” built into it, simple it isn’t. This flow chart shows how the property tax system works and who can influence it.

If I grossly simplify that process, there are four places to influence the final tax bill:

- The property value

- The % of that property value that is assessed (current 1/3)

- Deduction for any exemptions

- Mill levy (which is calculated by taking the total budget for taxing entities and dividing that by net taxable value for each county’s portfolio)

So simply said, our tax bill is calculated by taking:

Property value x % of assessment – allowed deductions = net taxable value x mill levy.

By having the law focus on only property value, it is possible to have no net change on the tax payers final properly tax bill. For example – if we had a law that said every property would double in value (say to reflect true market conditions) in 2010, then net impact on the tax bill would be no net change. (When you double the values, you halve the mill levy).

So in dealing with the two issues of tax lightning and fairness, my own personal belief is:

- At the time, (I was on a panel with him when he said this), the original intent of the Santa Fe assessor who wrote the some-what-disclosure & 3% cap law, he did so with the intent to protect the little old lady who has had the same house for 100+ years in Santa Fe – the idea was to keep her property taxes down even when the values were being pushed up by the Hollywood crowd moving into her neighborhood. This could have been handled through an exemption (like we do for Veterans and head of household, etc.), and we wouldn’t have the issues we do now. If the law was turned into the protecting the little old lady law through exemption, but it kept her property value

- I believe his true intent was to push through sales disclosure. The way the law was written, if an assessor disclosed information that had been disclosed to them, for every incident of disclosure, they were liable for a $1,000 fine, but the tax protest process requires the assessor to provide the protestant with complete copies of info (covered under part of the state statutes that deal with disclosure in court cases) – so I file a protest, the assessor uses 6 comparable sales that were disclosed to them by a property owner and that property owner could sue them for $6,000 – many of the 33 assessor’s were scared of this law and how to protect property info (I know of a county down south where you could “purchase” the assessor’s data set for a nominal amount of money).

- The 3% CAP was only supposed to protect the little old lady, not the average home owner, and certainly not the large apartment owner (22 counties consider apartments residential, 10 consider them commercial, and 1 just doesn’t know). BUT now that the law exists, I have been able to get my large apartment owners the same protection (no increase in value and a 3% CAP) – and as much as I love my industry, that just isn’t fair for our community.

- So looking at the law from every angle, there is no piece of the original legislation that provides transparency or disclosure.

- For residential, the law should be repealed entirely. The 3% CAP distorts everyone’s property taxes (when California passed proposition 13 (basically a limit on property tax increases), that state when from one of the best in schools and infrastructures to one of the worse.

- The commercial property owner and broker just isn’t paying attention – for example, let’s say you own a property in Rio Rancho – last year the residential property owners (who live in Sandoval County) voted to effectively double their mill rate by taxing themselves for a new college and hospital. The non-voting commercial property owner is now receiving a tax bill for $40,000 instead of $20,000 which has decreased their property value (in the short term at least) by $500,000 (8% CAP rate) or 20% of its original value of $2.5M.

- Furthermore, as the residential values decrease through the 3% CAP, the commercial property bears the burden of taxation. Although this next example is a different expense item, but it illustrates the unintended changes caused by new laws – in Florida, to reduce insurance costs, the legislature shifted more of the burden from residential to commercial – so much so that a 1,000 unit development project I worked on had a insurance bill as an apartment (commercial) that was 10 times higher ($2M) than if it was a condo (residential) which would have an insurance bill of $200,000. The Caps on increases of value for one property class will cause the same distortion.

- As it relates to newly developed properties – I have a client who tried to build a 300+ unit new construction apartment on Albuquerque’s Westside – its likely value was going to be lead to a tax bill that was 3.5 times higher than similar properties that had been built in previous years (which were subject to a CAP as well) – so the existing property owner had an unfair competitive advantage that caused this apartment not to be developed. To fix that, I think we would need a system where by new construction is phased in over 3 years to its full value AND we need a system that allows all property’s to be raised to their full value

- FAs it relates to bond issues, I believe when the voters vote, they need to understand that while their property taxes may (or may not) go up, by declining a bond issue, their property taxes could go down. Said another way if the ballot said “would you vote for a new library knowing that it would raise your property taxes by $40 a year for every $100,000 in value your house had (Y/N).” Then the tax payer/voter could consider the value the said public amenity (road, library, school, hospital, etc) adds to their community. Further consideration would have to be given to whether commercial benefits from every public service (fire/police= yes, library/school-no) and how we accommodate for that.

Finally, to have a fully fair and equitable process, any future laws need to model the impact on values based on the current mill levy, % of value, and property value and the outcome needs to be one where we can:

- Explain it to a new buyer or developer (for example – your property tax bill will likely be 1% of what you pay)

- Is transparent in operation (if I showed you the inequities in what we have now, and the loopholes that I as a tax consultant can use, you would be amazed at the lack of transparency)

- Is as fair as possible (i.e. you could look at your neighbor’s property tax bills and understand why they are similar (in value) or dissimilar (in exemption) as yours)

- Does it eliminate the abuse of unintended loophole as possible (when I was in China, they had a property tax that said you would only be taxed if your property was 100% complete – guess how many 40 story hi-rises I saw with an unfinished floor?)