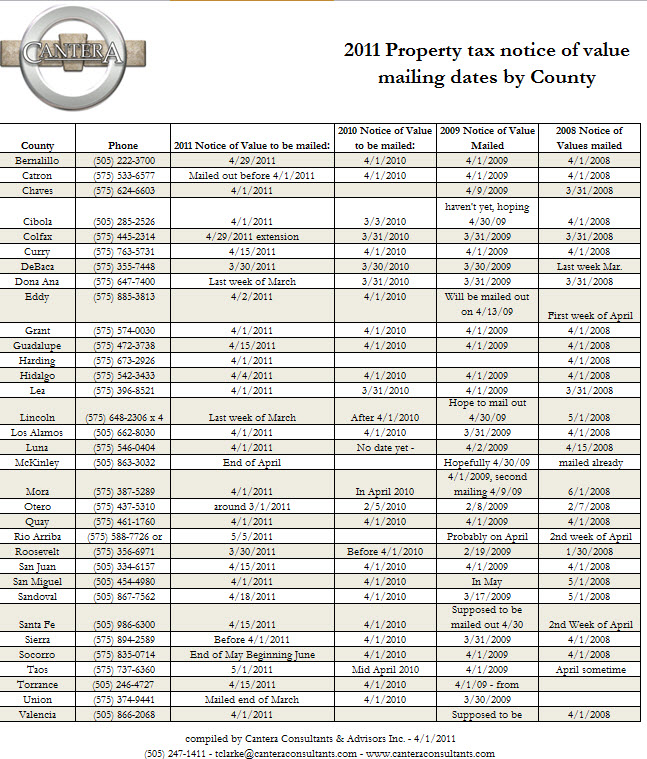

Earlier today, the Bernalillo County assessor announced that her office has sought and obtained approval to delay sending out notices of value for apartment buildings until June 15th, 2011.

This means the deadline to file a protest will be 30 days after that, or July 14th, 2011.

Single family and commercial property notice of values will be mailed out later this week with a deadline to file of May 30th, 2011.

As you know, last year was a tumultuous year for property taxes and apartments. Although our firm was able to obtain a significant reduction in apartment values, at the end of the day, this was done through strategy not a ruling from the formal tax board or the legal system. A legal ruling has yet to be made on whether apartments should have the same 3% cap as single family homes.

Those owners whose cases were not resolved are awaiting rulings from a handful of judges in district court. As was the case in previous years, it seems likely that one or two rulings will free up the balance of the pending litigation.

I would assume the assessor’s intent is to encourage one of the many judges to make a ruling prior to June 15th, 2011 deadline with the intent of using that ruling as direction for how to handle apartment values.

I believe this course of action is wise as it is going to take legislative, judicial or executive branch level action to correct the many property tax lightning issues.

Thanks,

Todd