OP-EDEquity in property taxes

Todd Clarke CCIM

The Albuqueruqe Journal editorial titled “Add Equity to State’s CAP on Property Taxes” dated January 23, 2009 contains only part of the information needed to make an informed decision about making changes to the NM property tax system.

As always, there are unintended consequences of any piece of legislation, and in 2000 the desire to protect New Mexico’s most vulnerable citizens, those low income seniors, has ended up protecting some of New Mexico’s largest property owners.

As the editorial indicated, House Bill 366 was enacted into law in 2000, was pushed by the Santa Fe County Assessor to protect long time elderly home owners from rapid increases in values from neighboring sales to out of state buyers. The stealthier part of this legislation was to undo a 30 year ban on the disclosure of real estate sales information. It is important to note that his legislation only impacted the taxable value of the property, not the tax bill (i.e. if the taxable value increased by the cap of 3%, but the mill levy increased 200%, the property owner’s tax bill would more than double).

Until the 2000 law was passed, County Assessors had a difficult time ascertaining “market value” for any given property, as they had a limited pool of comparable sales available to determine values. After the 2000 law, any residential property sold required that an affidavit be collected by the title company at the time of closing, disclosing the sales price of the property. Although the law stipulated five pieces of information be disclosed, some county assessors generated a multipage form that covered a lot more disclosure than the original law intended. The failure to do so allowed the county attorney to pursuing the seller and buyer for fines. The flipside of this legislation prevented the assessor offices from “disclosing” this sales information to the public, with the potential for similar fines and penalties to be applied to offending assessor’s employees. A year after the law was passed; some 80% of the county assessors who participated in an appraisal panel indicated a desire to repeal the law due to ambiguities in wording and the potential to create inequities in values between similar properties.

Those who spoke in favor of the disclosure of sales for residential properties indicated that with 3 to 5% of the housing inventory selling every year, in 15 to 20 years, many residential properties would be finally valued closer to “market value”.

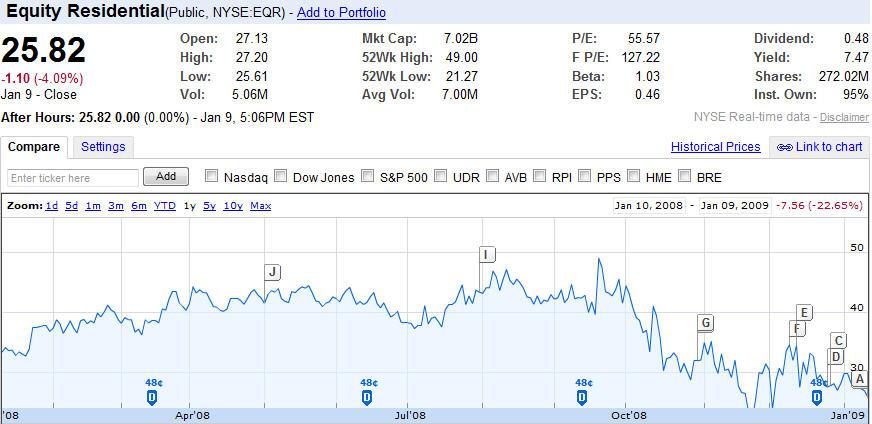

Unfortunately, the potential to increase many “residential properties” is overlooked as evidenced by the fact 85% of the large apartment sales sold in the last couple of years in the three counties that make up the Albuquerque Metro area witnessed no increase in taxable value, and in fact benefit from the 3% cap on property value increases.

Meanwhile, commercial property owners stood on the sidelines, neither enjoying the benefits of the 3% cap on increasing values, nor the downsides of disclosure of property sales hoping that no one realized that many commercial properties are significantly undervalued.

Based on the information maintained in a database by our firm, Cantera Consultants & Advisors Inc. (CCA) believes that on average, most assessors had the value of their county’s portfolio at about 65% of “market value”. Idiosynchroncies in the tax law like the fact that the property tax bill you receive today is based on the value of the property two years prior further distanced the gap between assessors value and market value.

The lack of clear definitions of terms like “market value”, “residential” and “commercial” only allow more ambiguity to creep into the valuation process. For example, a survey performed by CCA in 2008 discovered that of the 33 county assessors in New Mexico 68% of those assessors consider an apartment building residential, while 32% believe they are commercial, and believe it or not, one county assessor thought it might be both. The state constitution and laws that have followed since lack a clear definition of “residential” and commercial is defined as “non-residential”.

Unfortunately, the valuation of your property is just one of several variables that determine your property tax bill – another is the percentage of the property’s value that is used to calculate your net taxable value, which is currently limited in state law to 33.33%, but in previous decades fluctuated widely. In his book, Cowboy in the Round House, former governor Bruce King writes: “In those days (prior to 1970), your tax evaluation fluctuated along with who might be in power. If your political party was in, that was one thing. If not, that was another. Your assessment was strictly up to the tax equalization board, which consisted of the country commissioners, the county assessor, an at-large Democrat, and at-large Republican. If they wanted to assess a building at 10% of its value, that was what they used. If they wanted 50%, that was it. In some counties, the assessments ran all the way up to 90%.” This hardly created an equitable property tax sytem.

The other variables that come into play between the assessor’s valuation of your property and the treasurers invoicing of property taxes include: property type designation ( residential, commercial, agricultural, etc.), the percentage that is used to calculate net taxable, the mill levy, and qualified exemptions for veterans, head of households, low income seniors, etc.

Representative Boitano’s bill to extend the 3-percent cap to all properties only opens the door to even larger abuses of the ambiguities of the law and enshrines higher property tax bills for all participants by decoupling the connection between a property’s true value and its tax bill.

The second bill repealing the 2000 law would restore equity to the valuation process, but would leave low income senior citizens vulnerable to sudden increases in property tax bills. The most transparent place to provide cover for these citizens in the exemption category.

Ideally, if New Mexican’s truly want an equitable property tax system, future debate and legislation should decide if NM is a disclosure or non-disclosure state, clarify the definitions of property categories, provide guidelines for the consistency of the valuation process across all counties and discuss the merits of providing special exemptions for any of its citizens.

Todd Clarke CCIM, has been performing property tax protests for the last 18 years as a consultant at Cantera Consultants & Advisors, Inc. and teaches a NMREC approved course on “Understanding Property Taxes in NM”.