Believe it or not, this office folds flatter than an IKEA flat pack!

Month: November 2009

Possible solution for zoning issuess?

This make look like any ordinary residential area in California, but would you believe it if I told you it was actually a factory? Click here for more. I wonder why developer’s haven’t used this for industrial parks?

This make look like any ordinary residential area in California, but would you believe it if I told you it was actually a factory? Click here for more. I wonder why developer’s haven’t used this for industrial parks?

Mega development near Vegas…

The Hoover dam by-pass is under construction – Gizmodo (and my father-in-law) have forwarded some amazing photos of the construction of this bridge.

First CMBs in years – closes – $400M+, 1.44 DCR, 62.4% LTV

A possible solution for all the commercial real estate debt that is coming due?

Reading this article at the Economist got me thinking…

What if borrowed and lenders had a prenegotiated arrangement that converted debt into equity a commercial real estate deal? I don’t mean like todays, expensive involuntary conversion that happens through foreclosure, but a more organized rational, prenegotiated, pre-nupital like document that said something like “in the event of a capital crisis, or the mid-term (a average of this property’s value over the last 24 months) value of this asset decreases below the loan limit, borrower shall have mortgage their interest converted into an equity interest, thus unemcumbering the asset of all debt, freeing up cash flow which shall be distributed as follows… (cash flow going to lender, tax benefit going to equity position)… until such time as…”

Certainly debt would cost more, but an equity player might be willing to go into a deal knowing the downside was much lower.

The Economist has such a way with words

Take this example whereby they explain the inputs a home buyer needs to make a decision:

Most people face a future that comprises a combination of Donald Rumsfeld’s known and unknown unknowns. Choosing to buy a house, for example, involves a series of bets on land prices, interest rates, taxes, job prospects, future planning decisions in the area selected and the structural soundness of the property concerned. It is impossible for any buyer to be confident about so many variables. Any decision must be a guess.

Thanks to everyone who attended yesterday’s technology lunch and learn

In less than 90 minutes, we covered technology and how to best make it work for the commercial Realtor.

Everything from making presentations using your iphone and a portable projector, how to find a $200 netbook, take your office into the digital era by going paperless to the best tech tools to travel with.

The case for a national MLS

NAR announced their purchase of technology to construct the Realtors® Property Resource, a nationwide database of over 140,000,000 homes. Althoughthe press release denies the intent to make this anything more than a member benefit, it seems likely that a national MLS could follow.

Currently, local and regional MLS systems have a data sharing protocol to NAR’s national service – one that provides minimal info (for example, one of our fourplex apartment listings shows up as an 8 bedroom house), and some search abilities for buyers.

More and more buyers and agents are demanding the ability to get to information without having to worry about how to find the local MLS provider’s website first.

As you would expect with any large organization (NAR has about 1,000,000 members), they have had a hard time balancing the needs of the consumer, the agent, and the Realtor boards.

At the end of the day, a good friend, mentor and former Executive Officer of the first Commercial Association of Realtors (NM) in this country, once told me – “if you focus on your customers, customers, then your business will prosper”. (Thank you Nelson Janes!)

How about it NAR? Let’s focus soley on the real estate buyer and seller, and let the rest of the chips fall where they may.

If we don’t you can count on someone like Google to.

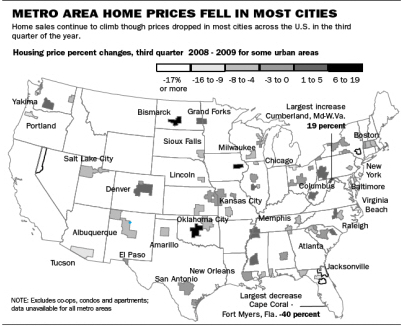

Albuquerque’s housing market continues to improve while USA shows decrease

According to a story in today’s Albuquerque Journal, 80% of this country’s cities showed a decrease in home sales prices, but Albuquerque remained on an modest upward trend.

“Third-quarter data showed the median sale price in the Albuquerque metro area was $183,500 — up from the first and second quarters — but down about 5 percent off the sale price of $193,400 in the third quarter of 2008. “

The Greater Albuquerque Association of Realtors has also indicated that the volume of sales has increased by 40% over this time last year.

One of the things to take into account, is that this does not necessarily indicate that home prices have shifted that much, as local agents will tell you there has been a lot of activity in the under $250,000 price range, and little activity in the over $1,000,000 price range, which is more than enough to cause the median price to decline

Its unfortunate that GAAR and NAR don’t do a same house comparison for appreciation/depreciation.