Measuring America: How an Untamed Wilderness Shaped the United States and Fulfilled the Promise of Democracy by Andro Linklater

This book has turned out to be one of my favorite real estate reads. Although many of America’s founding fathers were surveyors (George Washington and Thomas Jefferson included) this book extends its reach much further than just surveying the United States of America.

Politics, measurement systems, legal systems and the history of the acquistion/annexation of the lands that make up our fair country are all wound up into one compelling story that is underpinnned by one fundamental ideal – that those who “own” property are likely to active particpants in a viable democracy.

Items of interest that I was pleased to discover in this book:

– A renaissance of knowledge and learning was the vibrantly cradling our world and the people of the time who pushed the boundaries of idea and thought.

– the metric system was based on nature, where as the current American and former British systems of measurement were based on man

– Prior to the adoption of standard measurements, measurements of land were often based on how much land one man could plough in a day

– Jefferson was one of the primary proponets of adoption of the Metric system

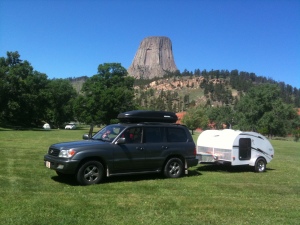

– the township and range divison of our country can be traced back to the surveyor’s chain

– the conversion of the 6 x6 township range to metric system (and thus all of the legal descriptions) would be all but impossible today

– Metes and Bounds (as in surveys) – actually was called Buttes and Bounds by Master (Surveyor) John Fitzherbet’s book, the Art of Husbandry, published in 1523 (p.7)

– The lack of standardized measurements was one of many components that our Congress debated in the creation of the founding papers that led to the creation of this country.

– Many of our original 13 colonies were founded as English Companies whose boundaries were described as latitudal numbers assuming the states ran from the Atlantic seaboard west to the Pacific Ocean (p. 30-31)

– In the early 1600’s, The Virginia company lost 6,000 of it’s 7,300 migrants and encouraged immigration by offering “headright” of 50 acres to anyone who would emigrate- by the 1630’s more people came to the state than those that perished in it, and those 50 acre parcel started to sell for about $1.25 per “headright”.

-Thomas Jefferson’s father, Peter Jefferson surveyed the southern boundary of 5 million acre estate of Lord Fairfax of Virginia (p. 38)

– George Washington at one point ownewd 52,000 acres across six states.

– The Viriginia Consitution drawn up in 1776 by George Mason read “That all men are by nature equally free and independent, and have certain inherent rights…namely, the enjoyment of life and liberty, with the means of acquiring and possessing property, and pursuing and obtaining happiness and safety.” (p.48)

– “Democracy depended on getting the land into the hands of the people” (p. 72)

– Land bubbles were created and caused by the mismatch between demand and supply (p. 148)

– Patrick Henry created America’s first land trust in 1765, known as the North American Land Company.

– The Louisiana Purchased involved $15M and an unknown quantity of land, which once measured, indicated that USA paid France about 5 cents per acre.

– As the Federal Government encouraged homesteading, the “section” and measurement of couldn’t have been made any easier (a quarter section is approx. 250 “double paces” or 440 yards x 440 yards) (p. 169)

– Manhattan was subdivided in such a way to encourage growth and make it readily apparent where the city’s master plan was headed

– My home state, NM was exceedingly difficult to survey due to the land grants which had the 1890 surveyor general remarking “Certain title to the land is the foundation of all values. Enterprise in this Territory is greatly retarded because that foundation is so lacking” (“Handicapped by the absence of a market in land, the New Mexico economy was slow to develop before the twentieth century, and much of the capital then had to come from the outside.” (p. 221)

– The railroads were land developers and in the 1800’s sold about 120 million acres, outstripping the 80 million acres the USA offered as free homesteads (p.228)

If any of the above tidbits whet your appetite to learn more about how our country grew, I would highly recommend this read.

* Link is a referal program to Amazon.com – any proceeds from book purchases are donated to the CCIM Education Foundation

)

)