2010 Bernalillo County Multi-family Property tax rollback – the rest of the story.

The following is a summary of an email sent to clients after our December 15th, 2010 hearing:

As I was working through a review and update of the apartment property tax lightning cases of 2010, I was reminded of the ancient Chinese blessing (or curse depending on your viewpoint):

“May you live in interesting times”

Many people are not aware that this blessing has two follow-up lines:

“May you come to the attention of the authorities” and

“May you come to find what you are looking for”

Unfortunately, 2010 was a year where all three of these came true for many of us. With that in mind, The following is an update on the property tax protests for your property.

The short version of this update is simple: we were able to get your property the lowest value we believe was possible in 2010, that value is final, and is not subject to any further litigation or appeals.

The long version as follows:

In my 22 years of handling property tax protests, 2010 was a unique year. State statutes indicate that the “value” year was 2007, which represent the tail end of the peak in the real estate market, and yet here in 2010, values in many cases had plummeted. We can add to that mix a county assessor who had recently been told by two different judges in district court that parts of a law passed by the legislature in 2002, and enforced by 33 county assessors was unconstitutional. As these recent changes in the law have had a big impact on how properties are valued, and it would be a safe to say this was a “perfect storm” that could wipe many property owners out.

Why we believe our client’s hire us at Cantera Consultants & Advisors Inc.

As it relates to handling property tax protests for our clients, we have found that successful protests involve more than knowing valuation technique and state statutes, it is also about knowing the people and having a strategy.

Our strategy this year was as follows:

– To use time to the advantage of our clients

– To research, develop, or create market information for the foundation of value negotiations

– To provide our clients with the risk/return analysis of the values that were negotiated with the assessor’s appraisers

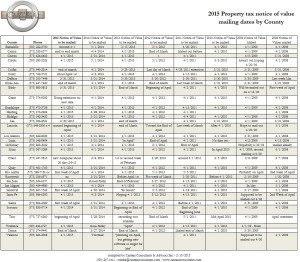

– To meet with our local politicians, keep abreast of the recent changes in law, and provide an continual education on our property tax system

– To keep our clients and the public informed as to the changes in the property tax arena

– To align ourselves with other professionals who have experience in the property tax protest arena and litigation (i.e. find a good attorney)

Market information

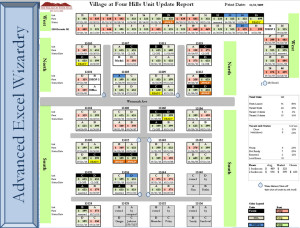

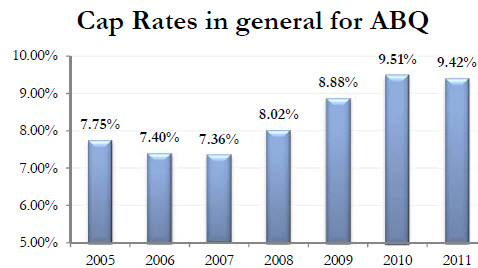

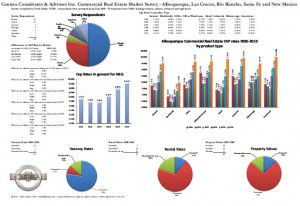

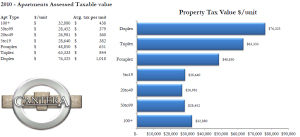

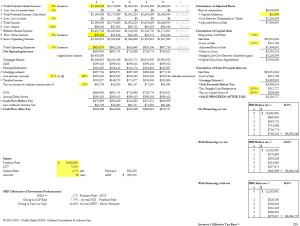

For the first time ever, our firm, Cantera Consultants and Advisor Inc., compiled a 5 year survey of occupancy, rental rates, CAP rates and value changes. This market information was published in the Albuquerque Journal earlier this year and was used to help our client’s in obtaining lower property tax values.

A bit of history about recent changes in the law

The law, known as the “property tax lighting” or “3% maximum increase” or “3% Cap on values” law limited the increase in values for residential properties by no more than 3%. What many people forget is that the law had other components, such as requiring all assessor’s to bring their entire portfolio to “current and correct values, which are to be no lower than 85% of market value” prior to implementing the cap.

The intention of this law was to minimize the impact of a property tax bill increase on the little old lady in Santa Fe whose neighborhood was being overrun by Hollywood types that were paying outlandish in prices for housing. The value of the little old lady’s house would rise to the recent sales, which would lead to an increase in her property tax bill to an amount she might not be able to afford.

While the intention of the law might have been noble, the thought process about how to implement it was poorly executed. If we as citizens of New Mexico have decided that the little old lady deserved protection, then the legislature could have granted her an exemption on her actual property tax bill. Instead, the law limited the increase of her assessed value by no more than 3% a year, or 6.1% every 2 years.

Anyone who has analyzed our property tax system knows that there are three variables that impact your final property tax bill. Your assessed value, the percentage of your property that is assessed, and the mill levy. In New Mexico, your assessed value should be close to “market value”, most properties are assessed at 1/3 of their market value, and the mill levy floats as a ratio between the county’s total property portfolio value and the budgets of those entities that tap into property taxes.

By limiting only the value of the property, the law did not limit the increases on the property tax bill. By requiring disclosure of all single family residential property sales, the law ensured the assessor had a ready pool of comparable sales, AND, many of us believed it opened the door for the legislature to consider a property transfer tax.

The law had some exemptions that allowed increases of more than 3%, including new construction, changes in zoning, and the sale of the property. If your property had experienced any of these, its value could be increased by more than 3%.

As property buyers came into title in their new property, they experienced a large increase in values, larger than the 3% of previous years, which led to the term of “property tax lightning” for the zapped feeling many of these owners experienced as their property tax bills shot through the roof.

From 2002 to 2009, residential property owners were repeatedly zapped with this unfair law. Typically, case law, or interpretation of laws in the court room allows our legal system to provide a balance against our legislature. Amazingly, it took a few years before a case was filed that impacted the interpretation of this law.

In 2009, a handful of property tax cases were brought against the Bernalillo County challenging the implementation of the exceptions to increasing values more than 3%. Two different judges ruled that the law was unconstitutional, and those cases have since been appealed, and now, on the eve of 2011, have still not been resolved.

Resolution or not, the message was clear – the legislature created a law that treated property tax owners differently based on the date of their purchase of a property.

At the end of 2009, and after these court rulings, the county assessor “rolled back” all single family home values that had been increased by more than 3% to their 3% limits.

As a side note – it is interesting to note that a legal opinion written about the same time as the law was being considered by the New Mexico Attorney general indicated that the while this new law may not be unconstitutional, “its application could be unconstitutional”.

Fast forward to spring of 2010, where the Bernalillo County assessor has two rulings that the 3% cap on increase law is unconstitutional. She decides to rolls back the value on some 45,000 single family homes that had experienced property tax lightning in former years.

As the overall value of the county’s portfolio is decreased by these roll backs, she also interprets that the law on limiting increase does not apply to apartment buildings based on their occupancy status and then she proceeds to raise the value on thousands of apartments across the county.

Although the decrease in single family values was not entirely offset by the increase in multifamily values, the timing of the two cannot be entirely coincidental.

Through out the summer, fall and winter of 2010, our office met with the county assessor’s appraisers and reviewed each of our client’s properties. In many cases, we were able to get a value reduction to the 2009 value plus 3%, or lower.

In some cases, we were able to get the value’s negotiated down close to the 2009 level +3%, and we signed off on those cases. Working with our client’s we performed a risk/return analysis that balanced an additional smaller decrease in value vs. the possibility of paying a property tax bill on the original assessed amount for many years as the cases worked their way through the property tax protest process and possible appeals into the legal system (keep in mind, those owners who prevailed in the 2009 single family property tax lightning cases are still paying higher property tax bills in 2009 and 2010 as their cases are still under appeal).

The balance of the property cases we had, totaling 30 in number, proceeded to formal hearings on December 15th, 2010. These were the most hard core cases, where none of the standard value techniques indicated a value remotely close to the 2009 plus 3%. In one particular case, while we able to reduce a property’s value by 50% from its 2010 assessment, the 2009 value plus 3% was another 50% lower. Each of these owner’s (including myself) indicated an ability to pay the higher property tax bill and a desire to continue their protest based solely on the legality of the removal of the 3% increase in values.

Assessor’s deposition

On November 19th, 2010, the Bernalillo County assessor was deposed by a handful of attorneys, including ours. I attended a majority of the deposition and I can tell you my summary at the time was that the most repeated answer in the 167 pages of the deposition, was “I don’t know”. Part of that consistent answer relates to the questions that some of the other attorneys asked – questions that showed a limited understanding of the assessor’s job duties, but the balance of the questions related to the assessor’s execution of the changes in values to apartments as it related to the removal of the 3% increase cap on values.

As you may know, there is a state statute that gives any county assessor a large advantage in formal hearings:

7-38-6. PRESUMPTION OF CORRECTNESS

Values of property for property taxation purposes determined by the department or the county assessor are presumed to be correct. Determinations of tax rates, classification, allocations of net taxable values of property to governmental units and the computation and determination of property taxes made by the officer or agency responsible there for under the Property Tax Code are presumed to be correct.

Our belief was that the assessor’s deposition demonstrated that this presumption of correctness should not be applied by the formal tax board in these apartment cases.

Timing

Based on last year’s single family property tax lightning cases, and our experience from previous years, we believe the longer we can wait to resolve our cases, the more our client’s benefit. For example, last year, some of our clients benefitted from recent court rulings that came late in the year. Said succinctly, each year the aggregate protests carry with them a body of knowledge, and by being last or close to last in the protest process, we benefit from that knowledge base.

The unfortunate side effect of waiting until the end is that the assessor was successful in getting an extension of their cases until after the December 10, 2010 property tax bills were due, so many of our clients received a bill for full value.

Our formal hearings for unresolved cases were scheduled for December 15th, 2010.

Ostrowski Decision

On November 30th of 2010, the formal property tax board found in favor of a property owner who owned a single family residential property that was rented out. The property in this case had sold in 2004, and had been hit with tax lighting, but its value was not rolled back as it was believed to be a “non-owner occupant” property. The board ruled that irrespective of the property’s occupancy status, it was not being treated uniformly with other similar properties. The board ruled that the value be rolled back.

Owings Star decision

On December 3rd, 2010, the formal property tax board found in favor of the county assessor in a case where an apartment owner believed that their property had been discriminated against based on its increase value of 25%. Unfortunately, the owner presented little in evidence to demonstrate said discrimination, and the formal property tax board, citing the case Hahn, Inc. vs. County Assessor that “the bar is set very high for a property owner claiming discrimination. What must be proven is an intentional scheme of discrimination, for which there is no evidence here”, and the formal board found in favor of the assessor.

Unresolved Decision

On December 9th, 2010, the formal tax board convened to hear the 40+ cases of another tax consultant and his attorney. Although the assessor had been subpoenaed to appear, the county attorney informed the board that she would not be appearing, and that the consultant, and their respective property tax owners, did not have the authority to subpoena an assessor to appear. Both sides tendered their briefs and this case should be ruled on by January 8th, 2011.

Clarke Stipulation

About a week before the hearing, our attorney, Stephanie Dzur (who prevailed in the single family residential property tax lightning cases in 2009), extended an offer to the county attorney’s office. The offer was an agreement that indicated we understood that the county assessor has been making decisions based on the information available at the time, and while we respected the difficult position she was in, we believed we would prevail at formal hearings, and as such, the county should agree to rolling back all of our pending protests to the 2009 values plus a 3% increase. As part of this offer, Mrs. Dzur shared with the county assessor our case, which we believed to be very strong.

Wednesday, December 15th, was our formal hearing for all remaining property tax protests for Bernalillo County. By Tuesday afternoon, we had been able to negotiate all of our pending cases down to the lowest values, subject only to the apartment cases that has experienced “tax lightning” or an increase of more than 3%.

Wednesday morning, I received a call from the assessor and she indicated that she wanted to meet with myself, the county attorney, and our attorney, Stephanie Dzur. The assessor indicated that based on how the formal board was ruling, she believed that apartments should not be treated differently, and although she intended to appeal some of the formal rulings, she was willing to resolve and sign off on the balance of cases if we could come to terms on a stipulated agreement.

Over the course of the morning, we modified the language of our original stipulation presented in our offer the week before.

Although we had an intellectual interest in pursuing the case through formal boards and a passion to put on our case, foremost in our minds was the issue of an appeal. The assessor had indicated that she was going to appeal the decision of the formal tax board, and similar to the property tax lighting cases of 2009, we were concerned that our client’s would be exposed to many years of property tax bills based on much higher amounts, until the legal system could provide a final and complete ruling.

By working through the stipulated agreement, you and our other clients would benefit from a lower property tax bill and a final decision that was not appealable. For each property that was subject to this agreement, I have already forwarded to you the stipulated agreement. The gist of it is that we agreed that the assessor interpreted the law based on the best information she had at the time, that the information was changing over time, and that we wanted our clients to benefit from that updated information by being treated the same as other the residential properties in 2010.

In the end, we believe we had the better hand, the better case, and that it led to the best possible outcome.

2011 and beyond

Many of our client have asked us what 2011 will hold, and to be candid, while I have many ideas as to what might come about with a new governor, a “refreshed” legislature, and an reelected assessor, I remain hopeful that they will have the courage to deal with this pressing issue head-on.

My largest concern for future years is the creeping of politics in the property tax system. In his autobiography, Former Governor King indicated that one of the many reasons he wanted the state constitution rewritten in the 1970’s was to push politics out of the property tax system. The laws that came out of that constitutional congress served our state well for over three decades, but all of that effort has been undone by recent laws. Until we repeal those laws, or modify our property tax system I remain concerned that politics and politicians will continue to provide uncertainty in our property tax system. That uncertainty translates to an opaque property tax system that will have an impact on all of our property values.

Fortunately, organizations like the Apartment Association of New Mexico and NAIOP are staying on top of these issues by meeting with our elected leaders to provide a better outcome. If you are not currently a member of both of these organizations, I would highly recommend signing up in 2011.

My apologies for the lengthy update, but I thought you might have an interest in the rest of the story. If you have an interest in copies of any of the above mentioned documents, don’t hesitate to let me know.

Thanks,

Todd

————————-

Todd Clarke CCIM

Cantera Consultants & Advisors Inc.

715 8th NW Albuquerque NM 87102

O 505-247-1411

M 505-440-TODD

F 800-791-4047

tclarke@nmapartment.com

www.nmapartment.com

Read Confessions of a Commercial Real Estate Consultant – www.toddclarke.com

————————-

Read the full article from the ABQ Journal here

Read the full article from the ABQ Journal here