Albuquerque Apartment market update2008 in review, looking forward to 2010 by Todd Clarke CCIM

The saying “may you live in interesting times” certainly seems to fit in today’s environment. Although the author and origin of this phrase is unknown, it is believed that it was composed as a curse and included two more phrases:

– May you come to the attention of those in authority

– May you find what you are looking for

Certainly, I think we could agree that our country’s financial sector is currently living under all three auspices.

In the following update, I attempt to summarize what is going on in today’s apartment market analyzing each of the components that the apartment market depends on for success, including a national perspective, and drilling down to our own local market.

Demand driver for apartment units

One of the fundamentals of the apartment industry is the concept that the occupancy of apartments is driven by population growth which is driven by job growth. By following job growth, one can make reasonable projections of future apartment occupancy.

National Employment

Between December 2007 and December 2009, unemployment increased by 2.3% to 7.2%, which means there are an additional 3,000,000 people without jobs. Unemployment has not been this high since 1992, and forecasts indicate this trends will likely continue as more and more companies are announcing layoffs.

Demand driver for apartment investors

The ability for an apartment investor to convert the equity in their property into cash depends on the liquidity of the financial markets, so financing is a major driver of buyer demand for apartment investments. When financing dries up the audience of future buyers becomes limited and, the investors risk rate increases as the safety of their net equity becomes less certain.

How did we get here?

Late in 2007, a perfect storm of excess liquidity, irrational exuberance, dubious rating assignments and quirky quant modeling (http://en.wikipedia.org/wiki/Quantitative_analyst ) assaulted investment markets in our country, and one by one, major banks, insurance companies, corporations, and now real estate investors are falling victim to the ensuing outcome.

As the economic trends continue to spread gloom and doom, comparisons are often made to depression era. I recently read John Kenneth Galbraith’s “The Great Crash of 1929” book which provides a detailed overview of that era. Certainly, some parallels exist between the two – the similarity of the downward spiral. The fact that both downturns were accelerated due to the great deal of leverage used for investments, limited cases of fraud, and the belief that the would continue to increase. The depression also was an unregulated free-for-all where numerous companies existed solely to invest in other companies, many of whom had only an idea and marginal cash flow or assets. Investors had limited information and bench marks to measure an investments return, except for its stock value. Today’s investor suffers from an overload of information and analysis, making it harder to sort out what is important and relevant versus the insignificant.

The largest difference between the 1930’s depression and today is three fold: improved transparency in market trades/information, increased sophistication of the market and increased oversight by our government.

Globally

From a macro perspective, part of the current economic crisis can be traced back to America’s ongoing trade deficit with countries like China. China in turn has reinvested our trade deficit dollars in USA government backed securities and treasury bills, effectively binding together the two countries economically even tighter. The national debt currently exceeds $10 trillion dollars (http://www.brillig.com/debt_clock/) and continues to increase at the rate of $3.31 billion a day since September of 2007.

China’s choice to reinvest those funds back into the United States, has increased the monetary supply, which has increased the access to capital for most investors. It created excess liquidity as there were more investors chasing few deals. As the market continued to climb to new heights, many investors started to believe in a “new methodology” for property values which only increased the disconnect between prices and the elementary market fundamentals. Said another way, as long as the market was increasing in value, more and more investors were willing to place their equity in any investment, with the hope of increasing prices, often ignoring the fact that the market was overdue for a correction, which historically purges the excesses of the market of equity and restore balance between the number of sellers and buyers of investments.

WTF? (where is the financing?)

On a Federal level, the government continues to encourage lenders to fund loans in the marketplace with carrots (bailouts), and sticks (threats of government takeover). Unfortunately the lack of liquidity in the marketplace will not be easily remedied with carrots or sticks, but only with trust.

The mortgage market has been cast as this decade’s financial villain, but the reality is that even though liar (no documentation) and ninja (no income, no job) loans did nothing to improve the industry’s reputation, only a small percentage of the market has actually defaulted on their loan.

The silent villain in this financial meltdown is also public policy or federal legislation. Although this legislation was intended to create more home ownership opportunities it did so by creating a new class of mortgages – subprime, named for the borrowers, who had less than ideal credit.

While the percentages of foreclosures for these mortgage products is higher than historical averages, there is something more toxic underlying these mortgages – known as CDO’s or collateralised-debt obligations. A recent article in the Economist does a fabulous job of describing these instruments and their undoing:

“Muddling the Mortgage

Yet the idea behind modeling got garbled when pools of mortgages were bundled up into collateralised-debt obligations (CDOs). The principle is simple enough. Imagine a waterfall of mortgage payments: the AAA investors at the top catch their share, the next in line take their share from what remains, and so on. At the bottom are the “equity investors” who get nothing if people default on their mortgage payments and the money runs out.

Despite the theory, CDOs were hopeless, at least with hindsight (doesn’t that phrase come easily?). The cash flowing from mortgage payments into a single CDO had to filter up through several layers. Assets were bundled into a pool, securitised, stuffed into a CDO, bits of that plugged into the next CDO and so on and on. Each source of a CDO had interminable pages of its own documentation and conditions, and a typical CDO might receive income from several hundred sources. It was a lawyer’s paradise.

This baffling complexity could hardly be more different from an equity or an interest rate. It made CDOs impossible to model in anything but the most rudimentary way—all the more so because each one contained a unique combination of underlying assets. Each CDO would be sold on the basis of its own scenario, using central assumptions about the future of interest rates and defaults to “demonstrate” the payouts over, say, the next 30 years. This central scenario would then be “stress-tested” to show that the CDO was robust—though oddly the tests did not include a 20% fall in house prices.

This was modeling at its most feeble. Derivatives model an unknown price from today’s known market prices. By contrast, modeling from history is dangerous. There was no guarantee that the future would be like the past, if only because the American housing market had never before been buoyed up by a frenzy of CDOs. In any case, there are not enough past housing data to form a rich statistical picture of the market—especially if you decide not to include the 1930s nationwide fall in house prices in your sample.”

-the Economist, “In Plato’s Cave”, January 22nd, 2009

Essentially, the Wall Street gurus packaged together a large bundle of mortgages, which then they split into a various pieces, obtaining a rating for each piece, obtaining insurance for those pieces with ratings, then selling those insured/rated portions of the mortgage pool as low risk assets.

Although there are a multitude of problems that have emerged, the largest is the total disconnect between the property owner and the property loan. As you pay the loan on your house today, the interest portion may go to one CDO, the principal portion to another, and the payoff of the loan to yet another. That all may work so long as you can make your loan payments. But if you lose your job and you can’t make loan payments, then which CDO do you negotiate with to buy more time?

Let’s say you’re an institutional investor, pension fund, or bank who owns a lot of these CDO’s and you see an uptick in foreclosures – in fact a doubling from the historical average of 3.5% to 7%. You would like to work with the property owners, but you don’t actually own their mortgage, just a piece of it. To work with the owner would require several other institutions to agree to work with the owner, which is unlikely, so the property goes into foreclosure.

With more foreclosures than the quant modeling indicated would ever be likely, the market for more collateralized mortgages evaporates, and now there aren’t any buyers for the good or bad parts of your portfolio.

Meanwhile, back in the neighborhood, home buyers are waiting to see if they can get a better deal from a future foreclosure than an existing seller, so the housing market starts to see a large decrease in the volume of sales. Pretty soon, buyers of home are waiting on the fence to see if better deals are around the corner, and the market activity goes from cool to freezing.

Without sufficient market comparable sales of homes or mortgage pools, it becomes harder for sellers of homes or sellers of mortgage backed securities to value their existing portfolios.

The nail in the coffin for a complete downward spiral: poorly defined account regulations

The lending log jam is further hampered by auditors in the accounting industry who feel the obligation to hold corporations to a series of accounting standards like the “FAS-157-Mark to Market” (http://www.toddclarke.net/?p=318). This standard impacts how corporations “value” their holdings. The auditors biggest complaint is the portions of this standard that leave it to the auditor to determine a discount rate. To an auditor, interpretation equates to increased auditor liability which further encourages the auditor to use a more aggressive discount rate than the market would typically experience.

The CCIM Institute is working with our nation’s leaders to provide clarity on these regulations. To quote CCIM’s national president, Mac McClure:

“Under the rules, the accountant must use three levels to mark to market: level 1 active trading market, level 2 observable market data, and level 3 auditor discretion or discounted cash flow. Just like the commercial real estate appraisal business, level 1 would imply the auditor must find comparables which, in a market like today, are really non-existent. Level 2 represents observable market data which, in today’s market, we have very little or no trading of Commercial Mortgage Backed Securities. Level 3 is the use of Discounted Cash Flow Analysis which is what we taught the RTC, FDIC, GAO, and all the other government agencies in 1987-1990 to use. In practice, accountants want to be told which one of these to use or they want to be given the flexibility to use the one that fits the situation clearly. Under the current rules, accountants are having a real problem getting to level 3 because of the wording “auditor discretion.” In my discussion with the head of one of the largest accounting and audit firms in the United States today, he said the word “auditor discretion” is the kiss of death for discounted cash flow because no auditor will jump that hurdle. Instead, they would rather deeply discount the value of the asset because there are no comparables or market data that subject themselves to the potential scrutiny of an Enron-type investigation. However, if those two words were eliminated, they would be free to use any of the three methods to underwrite value.”

As an analogy, let’s say you own a 100 unit apartment in a good location, that possesses minimal deferred maintenance, with a solid history of stable cash flows, that you recently purchased for $5M. In the last year, only one other apartment in that size range has sold and it was a a beater, down and out, crime infested in the worst neighborhood in the city. Since many sellers don’t have to sell, they wait to do so, which deprives the market place of good comparable sales, leaving only the desperate to sell.

According to an auditor/accountant, the lack of market comparables would make the Level 1 standard of an “active market” ineligible, and as this sale was the only “observer able market data” Level 2 doesn’t apply, so that leaves Level 3, the discount rate as the only available value option. Remembering the fate of Arthur/Anderson, the auditor picks a large discount rate (say 20%). All of a sudden the “value” of your property is far less than what you paid, than what you would sell it for today (or any day), and far less than the property’s loan, so your lender triggers a clause in your loan that allows them to call the entire balance if a particular loan to value ratio is not maintained. Foreclosure ensues, followed by a fire sale of the property, and if enough of these properties sell in distress, they will establish a new lower market value, which then starts the whole downward spiral over again.

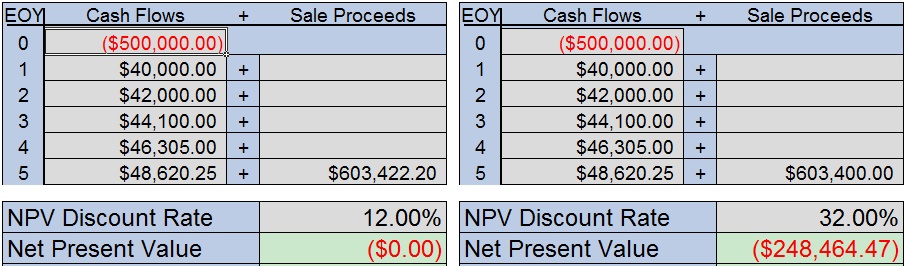

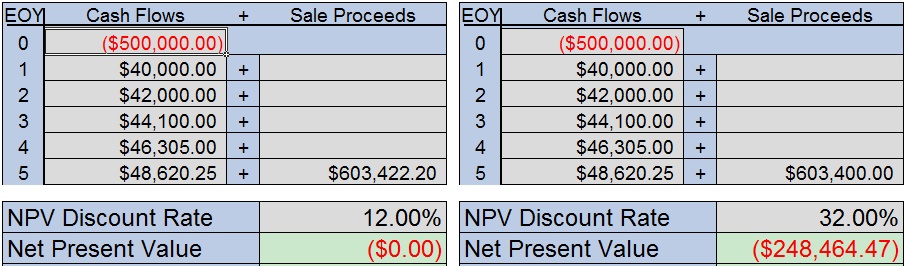

This example illustrates the difference of using an average and aggressive discount rate on the same fictional property’s cash flows:

Net value of the property at 12% IRR Net value of the property at 32% IRR

The table on the left indicates the return an investor would receive for a $500,000 down payment on a series of future cash flows and a disposition in year 5. This return is a reasonable 12%.

Lacking comparable sales, auditors might use a much higher discount rate, say 32%. On paper, the net value of the property has decreased by $248,464 or 50%.

This example demonstrates that even though the property’s cash flow remained unchanged, its dynamics where still in balance, and it was performing quite well, but a few misguided words of legislation put the property, and the investor’s equity into jeopardy.

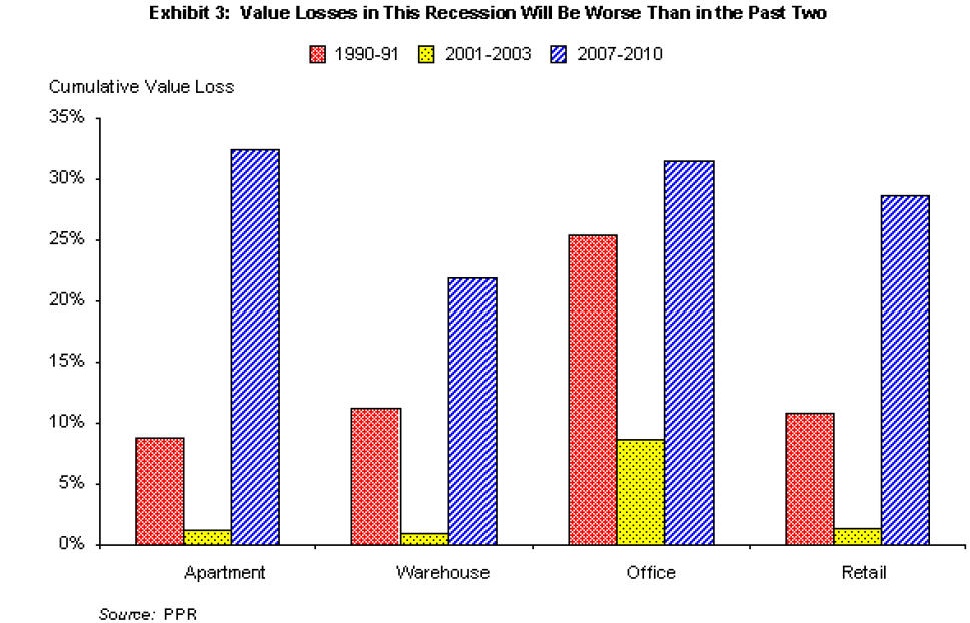

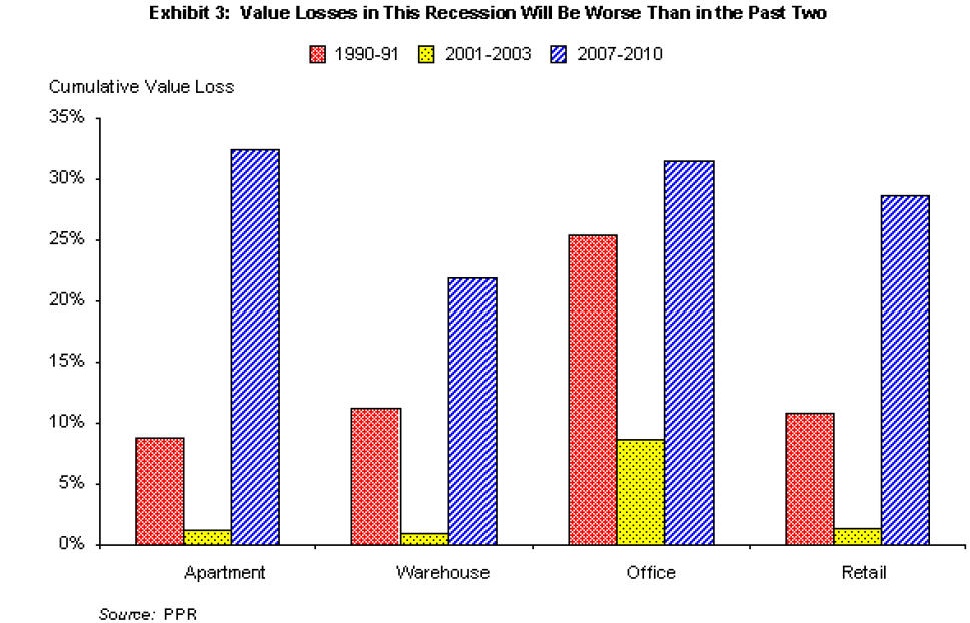

While this is a dire prediction, it seems many economists, like Susan Hudson-Wilson of Property Portfolio & Research (www.toddclarke.com/press/PPR_National_Employment-012009) are forecasting scenarios that include 32% decreases in national apartment values between 2007-2010.

Trust and transparency is at the heart of all these issues

So what happens if you are a financial institution holding a pool of mortgages or a portion of mortgages that are “highly” rated and the cash flow is less than what you thought? How do you value the balance of your portfolio if the accounting standards are not clear? How do you make sane business decisions when the rest of the market is extremely volatile?

You don’t – instead you end up losing trust. You can’t trust the valuations for your own portfolios and investments. If you can no longer assign value to your own portfolio then how can you trust that other companies and banks can?

Trust is the lubrication that keeps market gears turning.

Most of our financial system is built on trust. Banks that used to loan each other money short term, often overnight, no longer do so because they aren’t sure what kind of financial condition the lender, or the borrower is in. So they start holding on to cash. They start hunkering down.

Our Federal Government realized this for a brief time last fall when they offered to let financial institutions sell their toxic debt to the taxpayers, to get a clean start. But the fallacy in doing so was that the government assumed every institutions knew bad debt from good debt – and as we’ve already discussed, once the auditors apply a steep discount rate to all of your investments, bad and good start to look alike.

Transparency follows trust or as President Reagan was once quoted saying “Trust but verify”. During 2008, financial intuitions wrote down large portions of their portfolios value, but they couldn’t explain to their stock holders how they arrived at those write downs, and quarter after quarter, more and more write downs followed, to the point that stock holders no longer understood what they owned either.

To stop a run on the banks, the Federal Government created the Troubled Assets Relief Program (TARP). An impressive amount of federal money was set aside to become a safety net for the banks and their toxic debts. It has been more than three months since TARP was passed, and I think many people are starting to realize that what the banks truly needed is a safety net. A tarp covers your assets during a storm but this TARP has become an opportunity for the government to intrude into the day to day operations of a company on issues like the executive compensation and company sales junkets. It’s a bit like reshuffling the chairs on the Titanic right after it hit the iceberg.

It has been recently reported that there are a number of local and regional banks that opted out of the ability to tap into the TARP funds due to the uncertainty associated with the strings that the government is imposing on TARP recipients.

Keep in mind, part of this mess was created by social tinkering by our government and the thought that more tinkering, or taking on more debt will solve this problem appears counter intuitive to the solutions the market and this country need.

So what can the Federal Government do?

One economist indicated the best thing the government could do to expedite a cleanup of this financial mess would be to mandate all federally insured institutions replace their top management by a certain date, or risk losing FDIC insurance. As the new officers came on board, they would be extremely diligent in finding all of their toxic debt, and shedding it as part of their turn around process.

Lacking that, a second financial market could be created without the regulatory shortcomings of the current market. This new market should have clear accounting rules and more importantly, one regulator to report to.

In short, until transparency in the bank holdings is created, ideally with sound valuation methodologies, trust will not exist between the players which will only prolong the capital market crisis.

Translating the residential real estate market to the commercial real estate market

If residential mortgages provided the fuel for the CDO’s spark that led to the fire of the current meltdown, how has this spread to other markets?

For the most part, commercial real estate and apartments continue to have sound fundamentals, but many of these properties have loans that are payable in full in the next couple of years. One of the world’s largest industrial investors, ProLogis, has billions of dollars of loans that renew on stabilized, class A, industrial properties in the next couple of years.

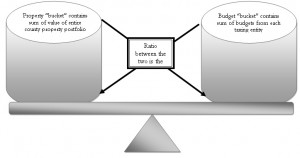

The shift from excess liquidity to scarcity of finance has put these investors in a tenuous position leaving them with the options of waiting it out, hoping liquidity is restored, or wholesaling their assets to use pent up equity to retire existing debt.

This has recently been evidenced by the thrashing of stock values experienced by Real Estate Investment Trusts like ProLogis, AIMCO, UDR, and General Growth. Most of which have started liquidating parts of their portfolio (http://www.toddclarke.net/?p=211).

And now, your local perspective

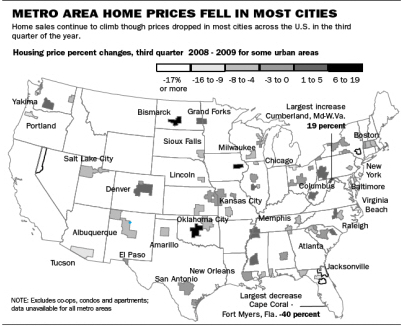

During 2008, Albuquerque felt like it lived in a parallel universe that was disconnected from the national economy – jobs continued to roll in, foreclosures were some of the lowest in the country, single family housing held on to most of its values, apartment occupancies continued to increase, as so did rental rates.

Albuquerque Employment Overview

The ongoing gloom and doom on a national level is starting to permeate the Albuquerque economy as the capital crunch continues to starve many businesses of the funding they need for day to day operations.

As you may know, Albuquerque was recently rated one of the top 5 cities in the country to build wealth in. Although the ups and downs of Eclipse Aviation’s bankruptcy have garnered major headlines, the labor department’s (http://www.dws.state.nm.us/dws-Mnews.html) latest release of employment data indicates that unemployment has been creeping up slowly since last summer’s announcement that it was at a 30 year low.

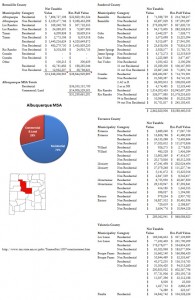

Albuquerque Sales last year

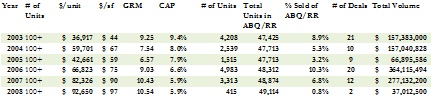

2008 was not a banner year for apartment sales in Albuquerque. The volume of sales decreased by 75% from $336M to $82M, with the 100+ unit apartments leading the way decreasing in sales from $277M to $37M. In fact, further analysis of the 100+ unit sales indicates that both sales that occurred in 2008, were actually put under contract in 2007. While the overall volume of sales decreased, valuation benchmarks showed only marginal decreases ranging from 10% to 15%.

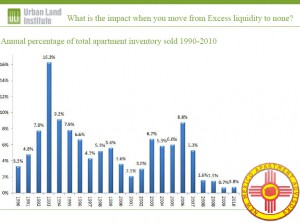

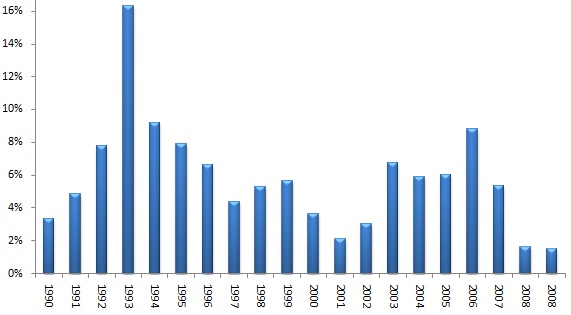

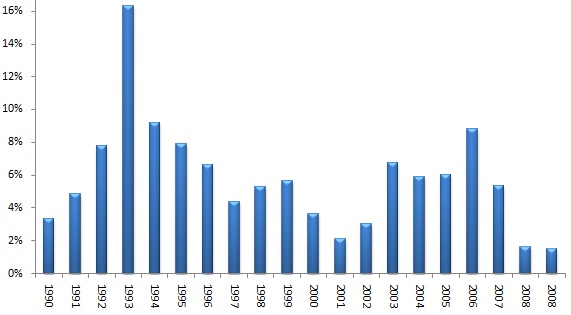

This graph shows the percentage of the total apartment inventory that sold year by year.

Break down by segment

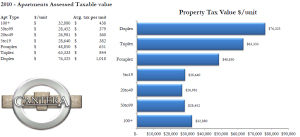

Albuquerque is unique in that it has such an abundant supply of small and medium sized units allowing the small property investors to work their way up the investment ladder over time – conceivably making it possible today’s fourplexes investor to own a 100+ unit property in twenty years. As that investor moves up the apartment investment ladder to larger properties, they are able to support on-site management staff, 3rd party management, and increasing sophistication in property operations.

NM Apartment Advisors has broken down the classification of apartment investments into physical category descriptions that reflect the typical investor for that size range. Each of these investors has a different approach to value and desired yield.

Distressed Sales

For the first time in a long time, distressed sales are starting to have an impact in the average value of New Mexico apartment sales. NM Apartment Advisors classifies a sale that is listed as “short”, “foreclosure”, “fire” or “handyman special” as a distressed sale. In typical years, the number of distressed sales has a marginal impact on the overall marketplace, but in 2008, some 18.4% of the sales that occurred were sales under distress, which skewed market values even more than expected. For that reason, for those segments of the marketplace that experienced distressed sales (mostly apartments containing 8 units or less), two categories of the 2008 summary have been provided, one has all sales, and the other that only reflects the non-distressed sales.

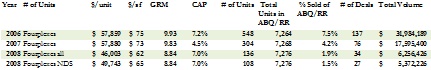

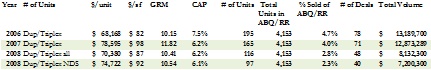

The following is a summary of each of these segments of the marketplace:

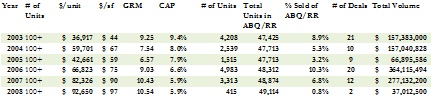

100+ units: in total, the 100+ unit apartments makes up over 60% of the total number of units, but only 4% of the total number of apartment communities. During 2005-2007 buyers binged by buying up some 20% of the marketplace. Although two sales in this size range occurred in 2008, both were marketed and under contract in 2007, effectively making 2008 a year with no sales in this catergory.

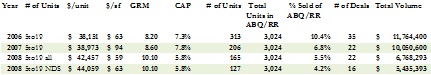

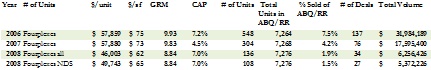

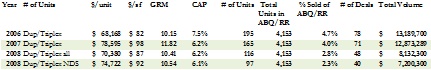

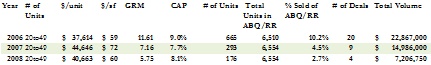

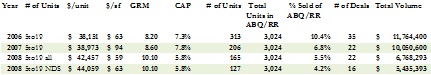

*the “% sold of ABQ/RR” heading above represents the market churn, or the percentage of the marketplace that sold that year

NM Apartment Advisors Inc. took a property to market in this category in 2008, and was able to secure 18 offers from qualified buyers, but increasing volatility in the capital markets made securing financing all but impossible.

In summary, while buyer interest remains strong, buyers are limited today by lack of financing choices. In 2009, the deals most likely to close will be delivered to a purchaser with attractive assumable financing, or seller financing.

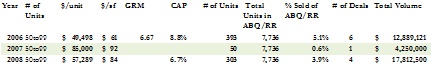

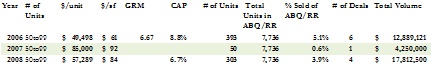

50to99 units: This segment of the marketplace makes up a small portion of the total inventory, and it is common to see very few transactions annually in this size range. For example, the only sale in 2007 was a 50 unit property that was sold to a condo converter. If we consider that sale to be an anomaly, then between 2006 to 2008, values on a price per unit increased 16%.

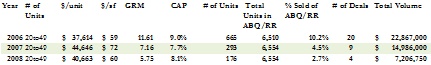

20to49 units: Like the 50 to 99 unit category, this portion of the marketplace is relatively small, but even it experienced a decrease in the total dollar volume of sales by 52%. CAP rates rose from 7.7% to 8.1% and the price per unit decreased 9% from its high in 2007.

5to19 units: While the overall volume of sales in this category decreased, the price per unit increased by 13%.

Fourplexes: although the fourplex marketplace only contains 9% of the marketplace in total number of units, they contain 35% of the total number of apartment communities. From 2007 to 2008, fourplexes experienced a decrease in sales volume of 64%, and a decrease in price per unit of 21%. 18% of all fourplex sales in 2008 were distressed sales, and even if those sales are excluded, the price per unit still decreased 14%.

Duplexes/Triplexes: Typically the units in this category often sell to owner/occupants who are more interested in the ability to live in the property than in its investment potential. Like the housing market, value decreases in this category are minimal. Adjusting for the 80% of the sales that were not distressed, the price per unit decreased by only 5%.

The impact of competitive investments in other markets

Although our office continues to receive phone calls from investors looking to expand their existing Albuquerque portfolio, many of them are chasing deals in markets that suffer from higher volatility like Phoenix, Las Vegas, the inland empire, and the Bay area which offer higher returns.

Local Financing

As dour as the financial news sounds, there are many local lenders in New Mexico who are continuing to loan on apartments. They’ve indicated that it’s back to the basics, sound property, sound borrower, sound underwriting, and for now, the lender is calling the shots on timing. Unfortunately, many of these lenders are capping their maximum loan at $20M.

To summarize

While Albuquerque’s internal economy is outperforming the national economy, the extended recession nationally is starting to take its toll locally and this could continue for a while. While many apartment values remain reasonably close to their recent high prices, an extended credit freeze could force more investors to liquidate at substantially discounted prices.

Our recommendation is simple – if your property has a loan that is good through 2012, and if you’re otherwise pleased with your property – we recommend you hold on to it until the national economy regains some sanity. If your property has a loan coming due in the next couple of years, we would highly recommend you begin working on refinancing that loan today, or worst case, realize that you may need to sell the property at a discount from the higher values the market experienced in 2006-2007.

The future going forward

Personally, I remain optimistic about the Albuquerque apartment market and I look forward to adding to our family’s portfolio with some of the opportunities that may arise this year.

And unlike the last major downturn, there is a lot of money waiting on the side lines, and a sense of optimism.

Rents/OccupancyStill to come – NM Apartment Advisors is currently updating its rent and occupancy survey, and upon completion, we will forward the results to you.

As always, I look forward to hearing from you about your property and your experiences during these interesting times.

Still here in New Mexico plugging away,

Todd Clarke CCIM

The above analysis is merely the opinion of a 20 year veteran in the commercial real estate sector, and it is based on the current market information, news stories, and anecdotal evidence as collected by its author, Todd Clarke. Additional analysis can be found on his commercial real estate blog, www.toddclarke.com.