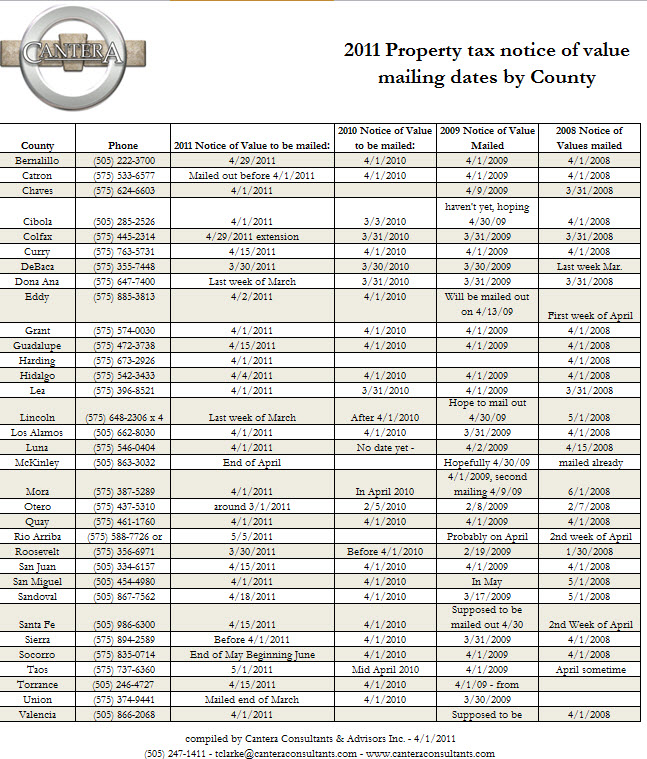

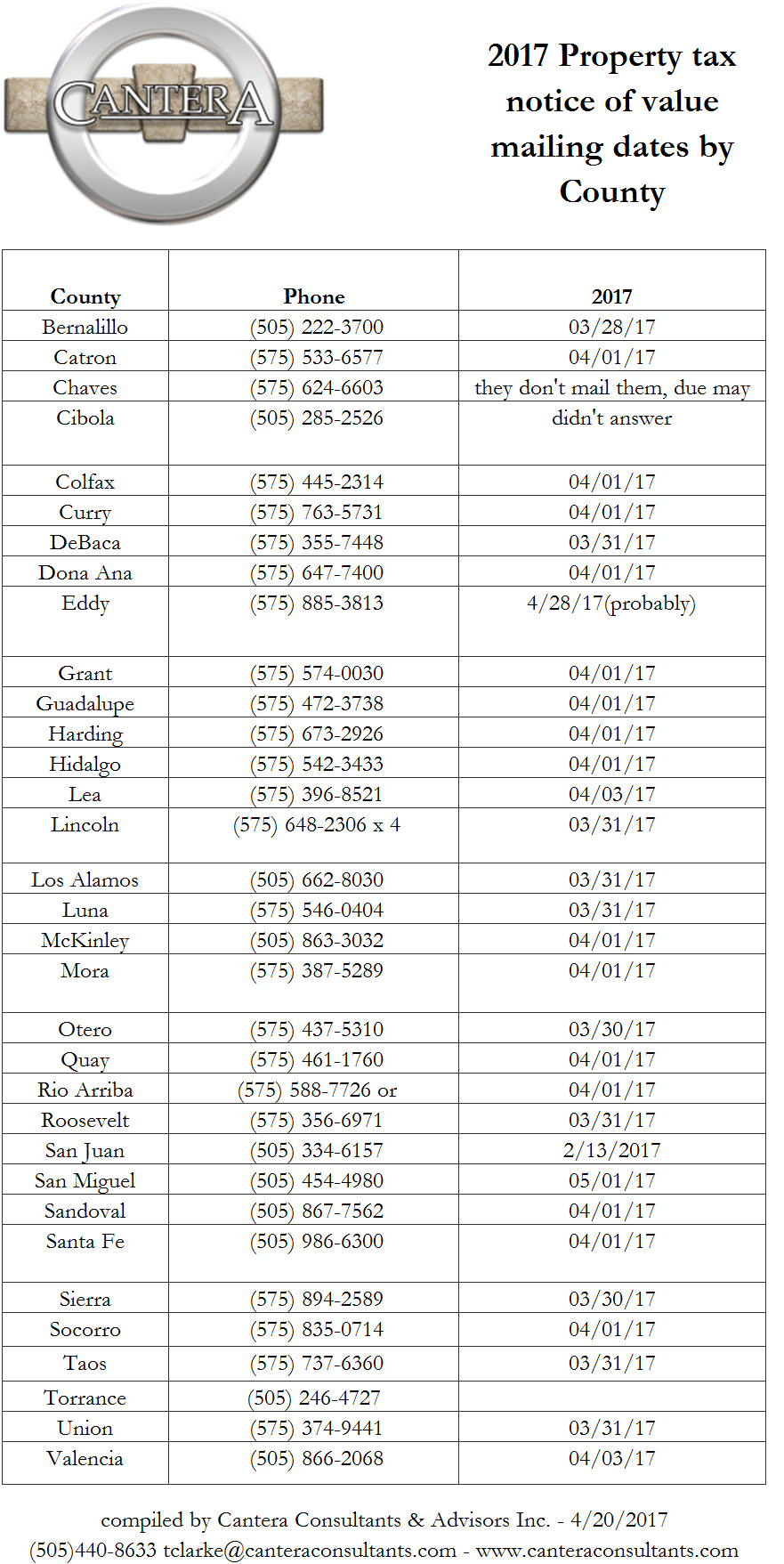

Please note that the deadline to file a protest is 30 days after the date on the notice of value.

Category: Property Taxes

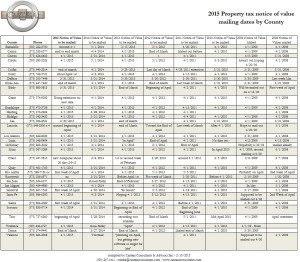

Property Taxes – notice of values update for 2015

Cantera Consulants & Advisors has just updated its notice of value dates from each of the county assessors.

Please remember that you only have 30 days from the date of the notice of value to protest your property taxes.

A PDF version of this table can be found here.

Bernalillo County Property Tax Protest board rules on LLC/refinancing issue at formal hearings

The Apartment Association of NM in the form of Attorney Gene Vance and property tax consultant Todd Clarke, represented apartment portfolio owner, Richard Fox, in the handling of his property tax protest case.

In the case, the property owner held title in a series of related Limited Liability Corporations (LLCs) for estate purposes. He and his wife had refinanced their properties in 2007 and again in 2013. In both cases the lender(s) required the property owner to move the ownership of the property from the LLCs, to his personal name before moving them back to the LLC.

In 2007, this related party transfer did not trigger a removal of the 3% cap on property value increases.

In 2014, the assessors office, based on a legal opinion obtained from the State of NM on a related property tax issues, removed the 3% cap and increased property values.

The formal boards ruling for this landmark case can be found here:

FinalDecision-Order-FoxPortfolio-10202014

The opening narrative for the case is as follows:

Attorney Gene Vance and I are here today not just representing our client, Richard Fox, but also the apartment industry through the Apartment Association of NM who has taken a keen interest the number of their members who have experienced a sharp increase in the property tax from the removal of the 3% Cap. These removals did not occur because the owner of the property sold their property, added on to their property or even rezoned their property. These removals were done solely because the property owner took advantage of historically low interest rates to refinance their property. In a post economic meltdown economy, many of the lenders required these owners to handle these refinances through related entity limited liability corporations or LLCs.

Before we lay out our case, I wanted to share with you a story. When House Bill 366 was approved and passed in 2001 and implemented in 2002, its intent was to protect the elderly widowed single family home owner in Santa Fe who risked losing her property due to a sudden and swift property tax increase caused by out of state, Hollywood moguls, purchasing properties around her.

Now, a dozen years later, our case focuses on a similar individual, our clients, Richard and Linda Fox, who have built up a small nest egg of rental investments over decades of ownership, tending to their residents and keeping their properties in good condition.

As part of their estate planning, to ensure continued uninterrupted management of their properties, and to plan for their future, they created a series of related party LLC’s. The need for this estate planning tool became more obvious when both Richard and Linda suffered from cancer in the last few years. Unfortunately, Linda did not survive, and she passed away earlier this year. Richard, who is in his 70s, and is like the elderly widow this law was created for, has had his protection removed by this assessor’s administration in a manner that is not consistent with previous administrations or other county assessors and in direct conflict with state law and a number of legal precedents.

Today, our evidence will show that Under the New Mexico Limited Liability Company Act, there was no change of ownership from substituting the owner’s name on the deed for that of the company. There was no beneficial interest transferred to a separate entity. Interpreting the law to cover these transactions is contrary to the policy behind the 3 per cent cap.

While we all are aware of the inequities created by the property tax lightning law and various follow-up Band-Aid approaches to fixing these, it is ironic the aged population this law was intended to protect is now being used as a weapon to raise their property taxes.

State of the apartment market – 2014

Property Tax update – 03/24/2014

The following is a quick update on property tax issues from 2013 and a preview of what we can expect in 2014 and 2015.

2013 protests

As you may recall, I did not expect 2013 to be a year that we would see much in the way of reductions. I did encourage some of my clients to file protests, because we had a new assessor and the top commercial appraiser had moved from Sandoval to Bernalillo. Unfortunately for us, that top commercial appraiser moved back to Bernalillo county mid 2013.

The reductions we were able to get in 2013 were a result of squeezing a bit more from the stone, rather than a new approach or philosophy.

Bernalillo and Sandoval county are aggressively reappraising right now – in fact, you can monitor Bernalillo countys progress here -http://www.bernco.gov/Assessor_Canvass . Remember, they are required to obtain the most accurate and correct information, and its been my experience if you are helpful on the front end (i.e. let them into your building, hold the other end of the measuring tape), they are more inclined to help you when it comes to the revaluation. Residential reappraisals are occurring on a map basis (i.e zone atlas page by zone atlas page)

As it relates to commercial properties, the only major increase I expect for 2014 will be for mini storage, assisted living and banks as they have completed their new valuations for these properties types. I’ve been told that the balance of commercial will show up in the 2015 notices of value.

Legislative update:

Our various trade associations like AANM and RANM were very busy this year tracking bills, responding to our legislators, and pushing back on bills that would have a drastic impact.

House Bill 178 (attached) was probably the most problematic of the bunch as it restored the increase of property taxes at time of sale starting in 2015. (a fuller update on this and other bills can be found below my signature line. Thanks to RANM for the update).

The Apartment Association of NM is working on raising funds and partnering with other associations to have a white paper completed this year that can be used to create new legislation to address the property tax lightning mess in the long 2015 session. Email me if you want more info on this process.

Property tax course

If you have an interest in learning how the property tax system works in NM, I will be teaching an 8 hour course a week from today (March 31st) at the Apartment Association – registration is mandatory (so we know how many books to print and bring and because we have limited seating – you can register at – www.canteraconsultants.com/cca2014 . Those of you in the real estate business should know that the course is approved for 8 CE credits. If you have an interest in learning how the property tax system works in NM, I will be teaching an 8 hour course a week from today (March 31st) at the Apartment Association – registration is mandatory (so we know how many books to print and bring and because we have limited seating – you can register at – http://www.canteraconsultants.com/cca2014 . Those of you in the real estate business should know that the course is approved for 8 CE credits. The course is $99 if you want a electronic (PDF) version of the book and $149 for a printed copy of the 300+ page textbook.

Notices of value for 2014

I will be updating our notices of value spreadsheet (2013 notice of value dates can be found here – http://www.toddclarke.net/?p=1656)

NOTE: The Bernalillo County assessor has sent out a notice to all property tax consultants that they need to update their client authorization signature pages. They have had issues in previous years with consultants “slamming” clients and filing without their approval. What does this mean for you? Just send me your notices of value (as they arrive) and I will send you a new contract for 2014.

While I am not expecting increases this year, I do expect previous properties that we have protested may have corrections in info that may lead to increases.

Thanks,

Todd

RANM update

2014 New Mexico Legislature Update []

From David Oakeley, RANM Government Affairs Director

February 21, 2014

The thirty day New Mexico legislative session is over and RANM was successful in getting three bills passed, two of them sponsored by RANM. House Bill 185 (HB185), the Commercial Real Estate Broker Lien Act and Senate Bill 124 (SB124), the Real Estate Foreign Broker Bill, passed in both the Senate and the House. SB110, the Real Estate Appraisers Act, was another high priority bill supported by RANM, also passed.

The bills will be sent to Governor Susanna Martinez for action.

THE 2014 SESSION

The whirlwind thirty day session had a less contentious feel due in part to a much narrower Democrat majority in the House of Representatives and with upcoming elections, neither side appeared anxious to engage in hostile partisan politics.

Some of the bigger issues were the budget, minimum wage, capital outlay and the Navajo Nation gaming compact. The $6.2 billion budget—dubbed a compromise—passed both Houses with apparent input from the Governor’s office. It includes a minimum 3 percent raise for State employees and teachers. The fear was that the budget battle would derail the session and result in the need for a Special Session.

A bill that would have increased the minimum wage in New Mexico narrowly passed in the Senate but failed in the House. It was the other way around for the Navajo Nation gaming compact that would have opened the door for two more Indian Casinos. The bill narrowly passed in the House but was defeated in the Senate.

HB55, the $232.6 million capital outlay bill, which funds projects throughout the state, also passed. $184.8 million of the projects will be funded with severance tax bonds, the remainder from other state funds.

THE RANM BILLS

One of the RANM-introduced bills that awaits the Governor’s signature—HB185—passed the House and was on the Senate calendar when time ran out. The Real Estate Appraiser Act was signed into law last year but amendments were introduced and passed this year to clear up some of the language.

HB 185, the Commercial Real Estate Broker Lien Act sponsored by Representative Antonio “Moe” Maestas, allows Real Estate Brokers to file a lien against commercial (not residential) property for leasing commissions owed by the owner of property if the property owner had a written agreement with the real estate broker to pay leasing commissions. You can download a copy of the bill by going to this link: http://www.nmlegis.gov/Sessions/14%20Regular/bills/house/HB0185.pdf

The other bill on the Governor’s desk is SB124,which amends the Real Estate Foreign Broker Bill, was introduced by Senator Phil Griego. The act was amended to add a definition of Commercial Real Estate and to allow out-of-state brokers to practice real estate in New Mexico with respect to commercial real estate only, provided they enter into a transaction-specific written agreement with a New Mexico real estate broker. For a full copy of this bill go to:

http://www.nmlegis.gov/Sessions/14%20Regular/bills/senate/SB0124.pdf

SB110 is the Real Estate Appraisers Act sponsored by Sen. Sander Rue, proposes to amend the Real Estate Appraisers Act in order to comply with federal law and to provide for appraisal management companies, trainees, an appraisal subcommittee, uniform standards or professional appraisal practice, automated valuation models, broker price opinions and criminal background checks.

OTHER HIGH PRIORITY RANM BILLS OF INTEREST

A “tax lightning bill” opposed by RANM, HB178 introduced by Representative Brian Egolf, never made it out of committee and died. RANM sent out a “Call to Action” on this piece of legislation. RANM members responded, many contacted their representatives, and it helped narrow the vote. It did narrowly pass in the House, 32-30. RANM considered this bill unconstitutional and deemed the caps on property evaluation would have the opposite effect and negatively impact real estate sales.

Another bill that addressed tax lightning, SB260 introduced by Senator Steven Neville, died in committee. This bill attempted to fix the tax lightning problem with the valuation and taxation of residential property. This bill transitions valuation to a percentage of the “current and correct” standard set in the Property Tax Code.

THE RANM LEGISLATIVE PROCESS

A total of 1,082 bills were introduced this thirty day session—549 in the House of Representatives and 533 in the Senate. Of all these bills only 126 of them survived; a success rate of a little over 11.6 percent.

Each bill usually gets one or more committee referrals, and if the bill survives all committee votes (some never even get a committee vote and thus fail to advance), they then face debate on the floor of the chamber in which they were introduced. If it passes it then goes to the other chamber where the process starts again. If the bill survives the second floor vote without amendment, then and only then, will it get consideration by the Governor who has 20 days after the session adjourns to take action which would be either to sign the bill, veto the bill, or not sign it (called a pocket veto).

RANM’s staff reviewed every bill and made recommendations to RANM’s Legislative Committee as to which pieces of legislation had a direct or indirect impact on the membership. A total of 104 bills—about 10% of those introduced—were so identified. They were categorized (taxes, water, regulatory, economic development, commercial, mortgage/lending, etc.), assigned the level of interest (high, medium, low), and whether they should be supported, opposed or simply monitored.

OTHER BILLS OF INTEREST TO RANM

The bills previously mentioned were high priority bills. Some other bills of interest included:

SB89, introduced by Sen. Peter Wirth, this bill would have affected the Gila River basin in southwest New Mexico, but never made it out of the Senate Conservation Committee. It would have required the Interstate Stream Commission to divert flood waters.

HB51, introduced by Representative Yvette Herrell and passed in both chambers, amends the Right to Farm Act, a pro-agriculture bill, passed both houses. It amends the Right to Farm Act to provide that no agricultural operation may be deemed a nuisance unless it is operated negligently. The New Mexico Department of Agriculture said about this bill, “Across the United States, nuisance law suits are being filed based on the encroachment of urban presence adjacent to agriculture activities. The consequence of nuisance or negligent lawsuits provides the potential to impair the state’s industry and the state’s economy and provides a negative impact on the ability for the industry to operate.”

HB273, introduced by Representative Ken Martinez and Senator Mary Kay Papen, is an economic development bill that passed both house and senate. It Proposes the Economic Development Grant Act, with a stated purpose to provide matching state grants to local and regional economic development agencies to expand their economic development and job-creation capacities through employment of economic development professionals. This bill appropriates $3 million for matching grants.

HJR8, this joint resolution introduced by Representative Jim Trujillo, authorizes the Energy, Minerals and Natural Resources Department to sell surplus property on East De Vargas Street in Santa Fe. The property was formerly used by the State Parks Division for administrative offices.

SM11, introduced by Senator Michael Padilla, (Identical to HM15), requests the United South Broadway Corporation’s Fair Lending Center, a nonprofit community development corporation that provides housing and foreclosure legal defense statewide, to convene a task force to study the foreclosure process and make recommendations to protect neighborhood and community stability, prevent unnecessary or improper foreclosures, and preserve the rights of families.

Property Tax Update

Spring is almost here, and that means its time to start looking in the mail for our notice of value property tax forms.

First on a macro level – the legislature is 12 days away from completing its 60 day session, and they are working on a couple of bills that could impact property owners.

House Bill 117 – appears to be DOA, and would have allowed a some disclosure to go into place – http://www.toddclarke.net/?p=1651

House Bill 521 – is working its way through various committees and currently has the support of RANM and the county assessors, but is being opposed by Apartment Association of NM which is attempting to make modifications to the bill – http://openstates.org/nm/bills/2013/HB521/documents/NMD00012252/

In it’s current form, HB 521 would not go into effect until 2014.

I recently taught the property tax course for a Santa Fe brokerage firm and they had invited two of the better county appraisers to attend. They were kind enough to share an interesting bit of info that should make tracking our notices of value easier – in 2014, notices of value should have a side by side comparison this years value vs. last years – an example can be found here – http://www.toddclarke.net/?p=1661

Notice of value dates

On a micro level – we have contacted all 33 assessors across the state as to their likely release dates for notices of value. A complete list can be found here – http://www.toddclarke.net/?p=1656 . Please note that their is an update for Bernalillo County (see below).

Changes at Bernalillo County

Although notices of value were prepared to go out earlier this year, Bernalillo County has a new assessor who has requested an extension until May 1st, 2013. For those of us who own commercial properties, their current valuation is in limbo as the commercial team is looking to hire a new commercial manager to provide direction for this years notices of value, all of which has led to a great deal of uncertainty as to what this means for values this year.

Class

If you need Continuing Education (CE) hours, or you think you would like to handle your own cases, we are offering our 8 hour “Understanding NM’s property tax system course” on 4/2/2013. The course is $99 if you use a PDF version of the textbook, or $149 if you need a printed one – seating is limited and registrations can be taken here – http://www.canteraconsultants.com/registration

As always, if you have any questions, please do not hesitate to contact me.

Thanks,

Todd

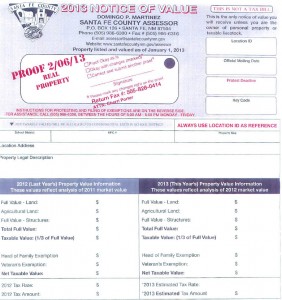

New Notices of value in 2014

Thanks to Gus in the Santa Fe County Assessor’s office for sharing the format of the new notices of value that should be standard in most counties in NM starting in 2014.

The major change is that these new notices of value now show your prior year valuation next to the current year, which allows the property owner to quickly identify an increase in property taxes due to value change.

A sample form can be found here.

SantaFeCounty-NewNoticeofValueForms-for2014-022013

The Santa Fe paper, the New Mexican, has reported this is part of a change in the law.

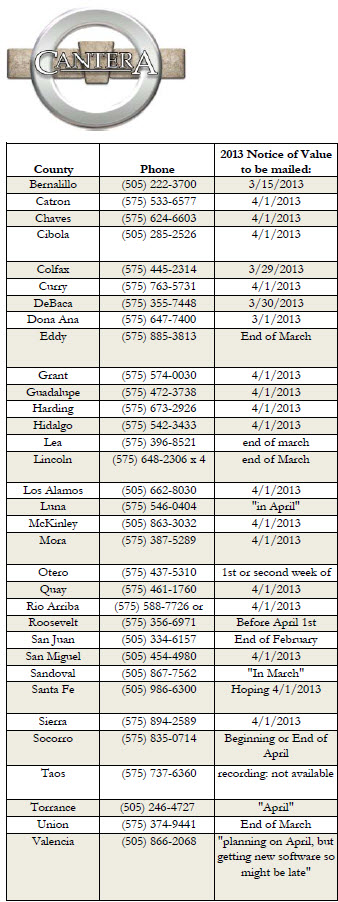

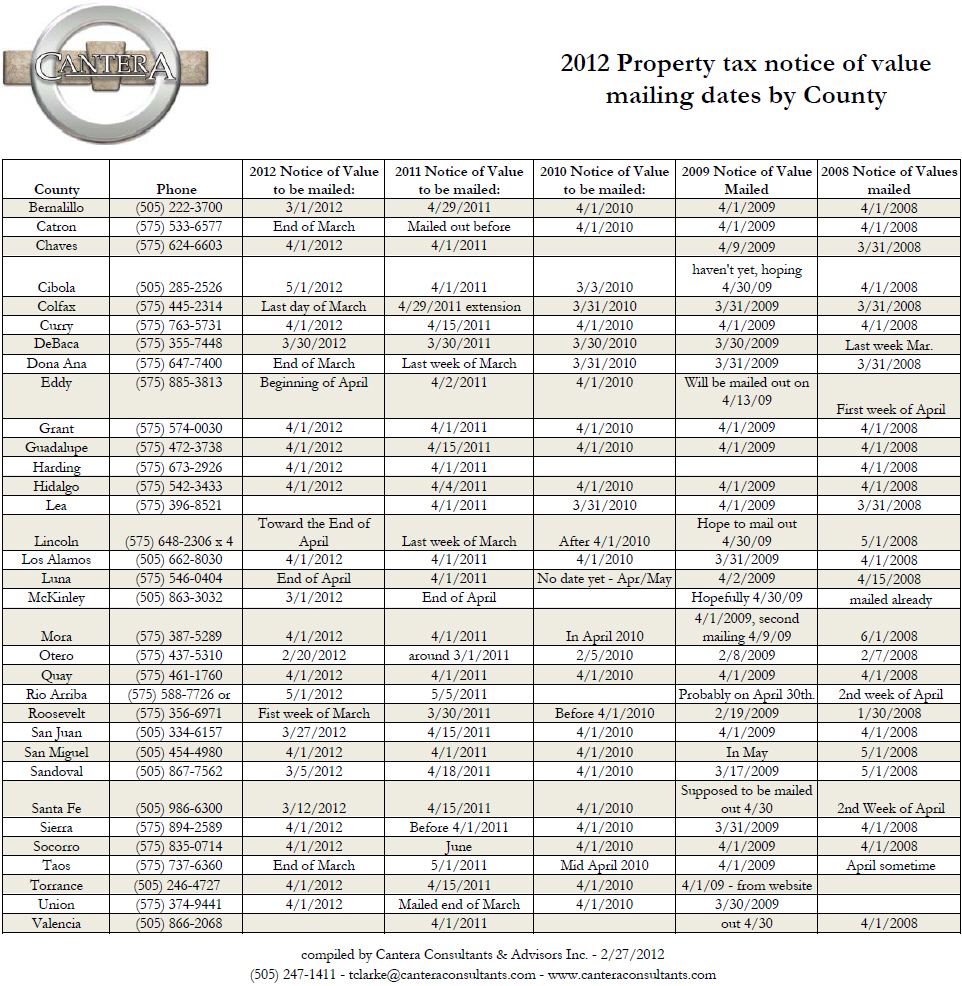

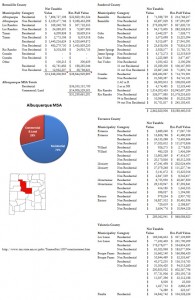

Notice of value dates for NM County Assessor’s

Our most recent survey of county assesor’s shows that most intend to send out notices of value on or before April 1st, 2013.

If you would like to compare these results with previous year – click here for our PDF version NM-CountyAssesorsNOVDates-2013-01242013 .

This is the kind of person I want looking after my states finances…

Yesterday’s Wall Street Journal reported that Susan Combs, Treasurer for the State of Texas is pushing for new legislation that would require local governments to add up their total debt obligations and disclose it to their constituents, the tax payer.

GREAT IDEA SUSAN!

Her office has also signed the light on Texas with a “Texas its your money” website that shares a ton of financial information about the states budgets.

New Mexican’s shouldn’t we demand the same?

Recent update on apartment property tax lightning

Both the Albuquerque Journal and  Channel 13 tv news have run recent overviews on the latest on apartment property tax lightning.

Channel 13 tv news have run recent overviews on the latest on apartment property tax lightning.

Property Tax update 2012 – should you protest?

I have had a number of clients ask me if we are still doing property tax protests, as they had received a handful of pieces in the mail from our competitors encouraging them to protest your property taxes, but not one from our firm.

2011 Status

Our office has only recently resolved our property taxes cases for 2011. The conclusion of these cases makes for the first time in 3 years that one year was complete before the next year started. During those 3 years we have protested over $745,000,000 in values, so from our perspective it certainly feels like most of the commercial and apartment buildings that could be protested have been done.

2012 protests

Although I am always glad to review your properties, for the most part I am recommending to my clients that they not protest their values this year. WHY you might ask? It’s simple, according to our value survey (attached), the market has started to turn the corner, and after 3 solid years of being able to lower our client’s property’s values, we think that window of time is drawing to a close.

Is there a downside to protest your property taxes every year?

Yes, when you file a protest, you open the door to an increase in value. If in reviewing your property’s info the assessor find cause to believe your property is under assessed, the can request an increase in value, and although I’ve never had it happen to me, I’ve had many assessors threaten to raise values, particularly when they feel a property owner filed a frivolous protest.

Material change in property in 2010 or 2011

I think the exception to this would be if your property has experienced a substantial physical or occupancy change in 2010 or 2011.

2013 is a reappraisal year

Although state law requires each county to reappraise its portfolio of properties every two years, many counties have gone for long periods of time with minimal increases in value.

Santa Fe County has announced that it has expanded its budget to bring all of the commercial properties to current and correct. My understanding is that Sandoval county is staffing up with the intent of revaluing all commercial properties, and Bernalillo County has indicated a similar effort.

Property Tax Lightning

As you may recall, the property tax lightning battle that is entering its fourth year, has been previously won a formal board level as well as district court, but those decisions have been appealed to the appellate court, which has not provided a ruling.

Apartment Tax Lightning

The back story for apartment tax lightning is a bit convoluted and long – so rather than bore you with the details, I can tell you that apartment owners continue to prevail in these cases – a summary of our 2011 cases can be found here – http://www.toddclarke.net/?p=1464 as well as the 2010 cases here- http://www.toddclarke.net/?p=969.

Class

If you would like to learn how our property tax system works, how to protest your own properties, or just need CE credit – our next course will be May 24th, 2012 – registration at www.canteraconsultants.com/registration

Textbook

If you don’t have time for the class, but would like the knowledge, we offer a 365 page textbook in both physical ($59 ) and digital form ($49 ). You can order your book online at www.canteraconsultants.com/bookk

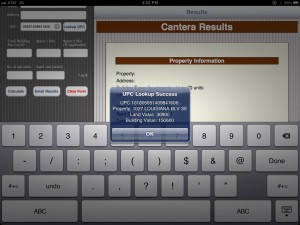

App

If you are curious as to your property’s value or if you ever need to look up your property taxes from your iPhone or iPad – consider our $0.99 app – which can be found online at http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 . The Taxessor App takes the values from resolved cases and matches them up to your property to give you an indication of whether it might be possible to obtain a reduction.

Resource to look up your property’s historical values

Finally, If you need to look up more than years history at a time and you are tired of multiple

“clicks” and screens on bernco.gov – try out website – www.nmapartment.com – (scroll down and look in the left hand margin for the “Lookup your property taxes” – once you enter your UPC # and go – it will pull up a 10 year history of notices of values, and tax bills all on one screen.

As always, if you need anything related to property taxes in New Mexico, don’t hesitate to email or call me

Thanks,

Todd Clarke CCIM

CEO

Cantera Consultants & Advisors Inc.

Apartment Property Tax Lightning update – 2011

On the 30th of January, 2012 our firm had a formal property tax protest hearing in front of the Bernalillo County property tax protest board.

The hearing took approximately 2 and 1/2 hours and the Bernalillo County assessor was represented by one commercial appraiser, one residential appraiser, the head of the residential department, as well as the county assessor.

We framed ourside of that case that this was not a not a decision of “value”, but rather implementation of the law and that the assessor’s office had not been executing the current laws consistently for all apartments. The assessor’s office framed their case as one of “value”, and we stipulated to the assessor’s updated value if the board found in favor of the assessors (this means that your property will receive a reduction either way, the only question is how much of a reduction).

Since we had close to a dozen apartment property tax lightning cases that had the same issue, we respectfully requested that the board here the arguments for all property’s and implement them individually on each property (this allowed the board to hear a dozen cases in 2.5 hours vs. 30 hours).

The outline document that is attached served as our narrative as we walked the formal property tax board through the following steps:

– demonstrate that your property is classified as residential

– demonstrate that your property had experienced more than a 3% increase

– demonstrate that other counties have been executing the law with no more than a 3% increase

– demonstrate that the Bernalillo County assessor’s office lost apartment tax lighting cases in 2010

– pull apart the logic underlying the assessor’s case as to why apartments should be treated different than single family homes

– pull apart the logic underlying the assessor’s case as to why apartments should be treated the same whether they are owner occupied or not

– share with the board the stipulated agreement we negotiated with the county in 2010

– remind the board of former board decisions that have found in favor of the apartment owner

– remind the board of former district court decisions that have found in favor of the apartment owner

Finally, we were able to get one of the appraisers to testify that the assessor’s office had a policy of rolling back apartments to the 3% over previous years value, but only in cases that had been previously protested, which demonstrated an uneven application of the law.

The assessor’s office presentation was focused entirely on how they had arrived at the value for the protest.

Unofficially, we have been informed from 3 different sources (including the assessor’s office) that we have prevailed in these cases, but as of this date, have not received written confirmation. As soon as we do, I will forward a copy for your files as well as an invoice showing the new value. The treasurer should then have their records updated prior to the May 2012 payment window.

If you would like a refresher on how our county got to where we are on apartment values – you can find a series of updates on our website at http://www.toddclarke.net/?s=property+tax, with the most detailed explanation at http://www.toddclarke.net/?p=969 .

Please email me if you would like to receive copies of the outline and/or the exhibits presented.

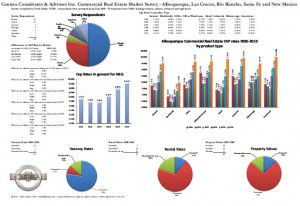

Valuation survey for NM Commercial Real estate released.

Cantera Consultants & Advisors has just released its 2011 value survey for NM Commercial Real Estate. The survey reflects the collective wisdom of industry professionals in NM.

Although Cantera uses the survey primarily for the benefit of it’s during property tax protest hearings, the survey has become staple in the commercial real estate market and is widely used and quoted by many of the brokerage, appraisal firms and county assessors in NM.

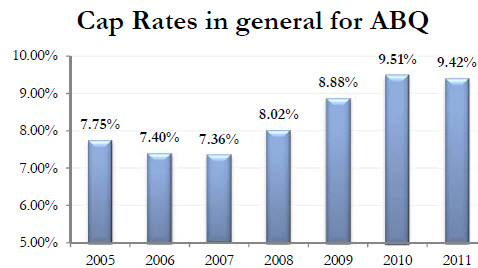

The most interesting trend reported in this year’s survey is the indication that most of the commercial property types have turned the corner on decreasing values as CAP rates have started to decrease (slightly).

Tomorrow’s edition of the Business Outlook in the Albuquerque Journal will highlight information from the report.

Last year’s survey results can be found here.

The 2011 value survey can be found CCA-Survey-10012011-v10.

Bernalillo County property tax update for apartments

If you own an apartment in Bernalillo County – the county assessor has obtained an extension on sending out notices of value. They will not be mailed out tomorrow, but should be sent out on 7/1/2011

Apartment Property Tax Lightning

Thanks to Channel 7, KOAT TV, for running this story on apartment property tax lightning.

Property tax presentation for NM IREM Chapter

can be found here:

IREM-PropertyTaxUpdate-05052011-v2

thanks again to the IREM chapter for allowing me to provide them an update and overview of NM’s property tax system.

Bernalillo County property tax udpate for multifamily properties:

Earlier today, the Bernalillo County assessor announced that her office has sought and obtained approval to delay sending out notices of value for apartment buildings until June 15th, 2011.

This means the deadline to file a protest will be 30 days after that, or July 14th, 2011.

Single family and commercial property notice of values will be mailed out later this week with a deadline to file of May 30th, 2011.

As you know, last year was a tumultuous year for property taxes and apartments. Although our firm was able to obtain a significant reduction in apartment values, at the end of the day, this was done through strategy not a ruling from the formal tax board or the legal system. A legal ruling has yet to be made on whether apartments should have the same 3% cap as single family homes.

Those owners whose cases were not resolved are awaiting rulings from a handful of judges in district court. As was the case in previous years, it seems likely that one or two rulings will free up the balance of the pending litigation.

I would assume the assessor’s intent is to encourage one of the many judges to make a ruling prior to June 15th, 2011 deadline with the intent of using that ruling as direction for how to handle apartment values.

I believe this course of action is wise as it is going to take legislative, judicial or executive branch level action to correct the many property tax lightning issues.

Thanks,

Todd

Update to Taxessor app now v2.1

iTunes had just pushed our latest update on the Taxessor app – it will now load your 2010 property tax values allowing you to compare your potential value with your current property tax value.

It is property tax season

Notices of value are in the mail, or will soon be in the mail. If you need assitance this year with your property taxes – we offer a number of services for you, your firm and your client including:

We have an “app” for that

If you are trying to determining if your value is “fair”, consider downloading our 99 cent app from the iTunes store – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8

Version 1 of the app takes the Bernalillo county resolved cases from 2010 and applies it to your property to help you determine what your value could have been. Because 2010 is a revaluation year, hopefully these values will go down. Version 2 of the app, which is awaiting approval of will automatically lookup your info from the county website and compare it to the potential value.

If you need some light reading, how about our 320 page textbook?

Now in its 5th edition, the text walks you through the property tax process including calculating your bill, determining if you should protest, and provides case studies of formal hearings and claim of refunds. Available in PDF format for $39 or printed for $49 at http://www.canteraconsultants.com/books

Property Tax Class – is on May 19th, 2011

This NMREC approved course is good for 8 CE credit hours and includes the above mentioned app and textbook and provides hands on training on how to handle your protest and covers our everything you need to “understand NM’s Property Tax System” – course registration for the 5/19/2011 course can be made at – http://www.canteraconsultants.com/registration

Representation

Finally, if that all sounds like a lot of work, you can hire our firm to represent you. We will analyze your property for free, and we charge you a small percentage of the savings only in the first year we obtain a reduction. Over the last 22 years, we’ve won 97% of our cases, representing over a billion dollars of commercial real estate with an average reduction of 23%. We charge 1/3 of what we save the client (i.e if we reduce their property tax bill by $10,000 then we charge $3,333) and we pay a 25% referral fee (on what we collect) to licensed agents, property managers or Realtors. If they choose to waive the referral fee, we can reduce our fee to 25% of the savings, and let the client know why they received a special discount.

If you have a property tax problem, look to us to be your solution.

Notice of value dates for property tax bills

my first iPhone app help client’s calculate their property taxes

Very excited – as of 5 minutes ago, our iPhone app to help client’s calculate their property taxes for commercial properties in Bernalillo County went “live” in the iTunes store! It is only 99 cents, and if you provide us feedback to improve version 2 and leave feedback, I’ll gladly send you a buck!

If you own a commercial property in Bernalillo County and you would like to compare your property’s value against the resolved cases from 2010, click here – http://itunes.apple.com/us/app/taxessor/id419811562?mt=8 to try it out.

The App is only $.99 and if you leave us a review and email me feedback at tclarke@nmapartment.com so we can improve version 2, I’ll gladly refund you a buck.

Thanks to Mark and Jamii at SWCP for making this happen.

Support for the app can be found here – http://www.taxessor.com .

Are you an owner occupant in a Bernalillo County apartment building?

If so – you might be able to get your 2010 property taxes reduced (for free).

According to the Bernalillo County Assessor, Karen Montoya, if you owner occupy an apartment (you will need proof in the form of a drivers license or utility bill), you can call the assessor’s office at 222-3700 to seek a reduction in your 2010 property tax bill.

The assessor’s office will “correct this error through an administrative change”.

Filing a claim of refund for 2010 property taxes

After many months of strategizing, negotiating, researching, and putting together our cases for our client’s, Cantera Consultants & Advisors Inc. recently settled all of its cases on the controversial apartment property tax lightning cases for 2010 (click here to read the summary).

In a recent (and copyrighted) Albuquerque Journal article, The Bernalillo County Assessor has indicated that she intends to roll back the 2010 values on all apartments that were raised more than 3% over their 2009 values.

If you own an apartment that experienced an increased of more than 3% in value (over 2009), and you did not file a protest by May 20th of 2010, there is one additional option available to reduce your property taxes for 2010 – you can file a claim of refund.

While this is a normal a service we offer our clients for contingency fee, in this unique situation, I believe the work we (and others) have done for our client’s this year has laid the foundation for the remaining apartment owners who haven’t filed to seek a refund.

If you meet the following criteria, you might be able to handle this case yourself:

– If you are the owner of a property not held in a partnership or corporation, you can represent yourself at district court to seek a refund of your property taxes.

– If you have already paid your property taxes, the full amount (not the first half installment)

– If you fill out a claim of refund (again, its more than a form, it is a lawsuit)

– If you file, in person, and pay the filing fee

In New Mexico, a claim of refund is lawsuit against the county, in which you, as the property owner, claim that you have overpaid the county in property taxes.

While I am not an attorney, and cannot offer any legal advice, I have been involved in a handful of claim of refunds and I can tell you that you can go to the district court website at www.nmcourts.gov and search the cases for the name “Karen Montoya” (our current assessor) and request a copy of a claim of refund from the court (you must do so in person, and they will charge you a copy fee) and use it as a model for your claim of refund.

You can also download Chapter 11 of our book “Understanding NM’s Property Tax System -2010 edition” that includes a blank form that we’ve used before. The deadline to file the lawsuit is 60 days after the property tax bills were sent out.

When filling out the form – be sure and look up your property’s property tax bill information at Bernalillo County’s website. Part of the form requires that you calculate what your property tax bill should be (based on 2009 values + 3%) vs. what it was on the actual tax bill.

Most tax consultants, such as our selves, are also working with attorneys and can provide assistance, but this maybe one of the rare situations, where everything has already been resolved (thanks to those owners who filed protest, and there consultants/attorneys who worked through the cases in 2010), that an owner maybe able to simply handle this themselves.

****disclaimer – in case I haven’t made it totally clear – this information is provided as a public service, and it not intended to offer legal or real estate advice. Going to court without legal representation is not a wise idea.

Property Tax protests update for 2010

2010 Bernalillo County Multi-family Property tax rollback – the rest of the story.

The following is a summary of an email sent to clients after our December 15th, 2010 hearing:

As I was working through a review and update of the apartment property tax lightning cases of 2010, I was reminded of the ancient Chinese blessing (or curse depending on your viewpoint):

“May you live in interesting times”

Many people are not aware that this blessing has two follow-up lines:

“May you come to the attention of the authorities” and

“May you come to find what you are looking for”

Unfortunately, 2010 was a year where all three of these came true for many of us. With that in mind, The following is an update on the property tax protests for your property.

The short version of this update is simple: we were able to get your property the lowest value we believe was possible in 2010, that value is final, and is not subject to any further litigation or appeals.

The long version as follows:

In my 22 years of handling property tax protests, 2010 was a unique year. State statutes indicate that the “value” year was 2007, which represent the tail end of the peak in the real estate market, and yet here in 2010, values in many cases had plummeted. We can add to that mix a county assessor who had recently been told by two different judges in district court that parts of a law passed by the legislature in 2002, and enforced by 33 county assessors was unconstitutional. As these recent changes in the law have had a big impact on how properties are valued, and it would be a safe to say this was a “perfect storm” that could wipe many property owners out.

Why we believe our client’s hire us at Cantera Consultants & Advisors Inc.

As it relates to handling property tax protests for our clients, we have found that successful protests involve more than knowing valuation technique and state statutes, it is also about knowing the people and having a strategy.

Our strategy this year was as follows:

– To use time to the advantage of our clients

– To research, develop, or create market information for the foundation of value negotiations

– To provide our clients with the risk/return analysis of the values that were negotiated with the assessor’s appraisers

– To meet with our local politicians, keep abreast of the recent changes in law, and provide an continual education on our property tax system

– To keep our clients and the public informed as to the changes in the property tax arena

– To align ourselves with other professionals who have experience in the property tax protest arena and litigation (i.e. find a good attorney)

Market information

For the first time ever, our firm, Cantera Consultants and Advisor Inc., compiled a 5 year survey of occupancy, rental rates, CAP rates and value changes. This market information was published in the Albuquerque Journal earlier this year and was used to help our client’s in obtaining lower property tax values.

A bit of history about recent changes in the law

The law, known as the “property tax lighting” or “3% maximum increase” or “3% Cap on values” law limited the increase in values for residential properties by no more than 3%. What many people forget is that the law had other components, such as requiring all assessor’s to bring their entire portfolio to “current and correct values, which are to be no lower than 85% of market value” prior to implementing the cap.

The intention of this law was to minimize the impact of a property tax bill increase on the little old lady in Santa Fe whose neighborhood was being overrun by Hollywood types that were paying outlandish in prices for housing. The value of the little old lady’s house would rise to the recent sales, which would lead to an increase in her property tax bill to an amount she might not be able to afford.

While the intention of the law might have been noble, the thought process about how to implement it was poorly executed. If we as citizens of New Mexico have decided that the little old lady deserved protection, then the legislature could have granted her an exemption on her actual property tax bill. Instead, the law limited the increase of her assessed value by no more than 3% a year, or 6.1% every 2 years.

Anyone who has analyzed our property tax system knows that there are three variables that impact your final property tax bill. Your assessed value, the percentage of your property that is assessed, and the mill levy. In New Mexico, your assessed value should be close to “market value”, most properties are assessed at 1/3 of their market value, and the mill levy floats as a ratio between the county’s total property portfolio value and the budgets of those entities that tap into property taxes.

By limiting only the value of the property, the law did not limit the increases on the property tax bill. By requiring disclosure of all single family residential property sales, the law ensured the assessor had a ready pool of comparable sales, AND, many of us believed it opened the door for the legislature to consider a property transfer tax.

The law had some exemptions that allowed increases of more than 3%, including new construction, changes in zoning, and the sale of the property. If your property had experienced any of these, its value could be increased by more than 3%.

As property buyers came into title in their new property, they experienced a large increase in values, larger than the 3% of previous years, which led to the term of “property tax lightning” for the zapped feeling many of these owners experienced as their property tax bills shot through the roof.

From 2002 to 2009, residential property owners were repeatedly zapped with this unfair law. Typically, case law, or interpretation of laws in the court room allows our legal system to provide a balance against our legislature. Amazingly, it took a few years before a case was filed that impacted the interpretation of this law.

In 2009, a handful of property tax cases were brought against the Bernalillo County challenging the implementation of the exceptions to increasing values more than 3%. Two different judges ruled that the law was unconstitutional, and those cases have since been appealed, and now, on the eve of 2011, have still not been resolved.

Resolution or not, the message was clear – the legislature created a law that treated property tax owners differently based on the date of their purchase of a property.

At the end of 2009, and after these court rulings, the county assessor “rolled back” all single family home values that had been increased by more than 3% to their 3% limits.

As a side note – it is interesting to note that a legal opinion written about the same time as the law was being considered by the New Mexico Attorney general indicated that the while this new law may not be unconstitutional, “its application could be unconstitutional”.

Fast forward to spring of 2010, where the Bernalillo County assessor has two rulings that the 3% cap on increase law is unconstitutional. She decides to rolls back the value on some 45,000 single family homes that had experienced property tax lightning in former years.

As the overall value of the county’s portfolio is decreased by these roll backs, she also interprets that the law on limiting increase does not apply to apartment buildings based on their occupancy status and then she proceeds to raise the value on thousands of apartments across the county.

Although the decrease in single family values was not entirely offset by the increase in multifamily values, the timing of the two cannot be entirely coincidental.

Through out the summer, fall and winter of 2010, our office met with the county assessor’s appraisers and reviewed each of our client’s properties. In many cases, we were able to get a value reduction to the 2009 value plus 3%, or lower.

In some cases, we were able to get the value’s negotiated down close to the 2009 level +3%, and we signed off on those cases. Working with our client’s we performed a risk/return analysis that balanced an additional smaller decrease in value vs. the possibility of paying a property tax bill on the original assessed amount for many years as the cases worked their way through the property tax protest process and possible appeals into the legal system (keep in mind, those owners who prevailed in the 2009 single family property tax lightning cases are still paying higher property tax bills in 2009 and 2010 as their cases are still under appeal).

The balance of the property cases we had, totaling 30 in number, proceeded to formal hearings on December 15th, 2010. These were the most hard core cases, where none of the standard value techniques indicated a value remotely close to the 2009 plus 3%. In one particular case, while we able to reduce a property’s value by 50% from its 2010 assessment, the 2009 value plus 3% was another 50% lower. Each of these owner’s (including myself) indicated an ability to pay the higher property tax bill and a desire to continue their protest based solely on the legality of the removal of the 3% increase in values.

Assessor’s deposition

On November 19th, 2010, the Bernalillo County assessor was deposed by a handful of attorneys, including ours. I attended a majority of the deposition and I can tell you my summary at the time was that the most repeated answer in the 167 pages of the deposition, was “I don’t know”. Part of that consistent answer relates to the questions that some of the other attorneys asked – questions that showed a limited understanding of the assessor’s job duties, but the balance of the questions related to the assessor’s execution of the changes in values to apartments as it related to the removal of the 3% increase cap on values.

As you may know, there is a state statute that gives any county assessor a large advantage in formal hearings:

7-38-6. PRESUMPTION OF CORRECTNESS

Values of property for property taxation purposes determined by the department or the county assessor are presumed to be correct. Determinations of tax rates, classification, allocations of net taxable values of property to governmental units and the computation and determination of property taxes made by the officer or agency responsible there for under the Property Tax Code are presumed to be correct.Our belief was that the assessor’s deposition demonstrated that this presumption of correctness should not be applied by the formal tax board in these apartment cases.

Timing

Based on last year’s single family property tax lightning cases, and our experience from previous years, we believe the longer we can wait to resolve our cases, the more our client’s benefit. For example, last year, some of our clients benefitted from recent court rulings that came late in the year. Said succinctly, each year the aggregate protests carry with them a body of knowledge, and by being last or close to last in the protest process, we benefit from that knowledge base.

The unfortunate side effect of waiting until the end is that the assessor was successful in getting an extension of their cases until after the December 10, 2010 property tax bills were due, so many of our clients received a bill for full value.

Our formal hearings for unresolved cases were scheduled for December 15th, 2010.

Ostrowski Decision

On November 30th of 2010, the formal property tax board found in favor of a property owner who owned a single family residential property that was rented out. The property in this case had sold in 2004, and had been hit with tax lighting, but its value was not rolled back as it was believed to be a “non-owner occupant” property. The board ruled that irrespective of the property’s occupancy status, it was not being treated uniformly with other similar properties. The board ruled that the value be rolled back.

Owings Star decision

On December 3rd, 2010, the formal property tax board found in favor of the county assessor in a case where an apartment owner believed that their property had been discriminated against based on its increase value of 25%. Unfortunately, the owner presented little in evidence to demonstrate said discrimination, and the formal property tax board, citing the case Hahn, Inc. vs. County Assessor that “the bar is set very high for a property owner claiming discrimination. What must be proven is an intentional scheme of discrimination, for which there is no evidence here”, and the formal board found in favor of the assessor.

Unresolved Decision

On December 9th, 2010, the formal tax board convened to hear the 40+ cases of another tax consultant and his attorney. Although the assessor had been subpoenaed to appear, the county attorney informed the board that she would not be appearing, and that the consultant, and their respective property tax owners, did not have the authority to subpoena an assessor to appear. Both sides tendered their briefs and this case should be ruled on by January 8th, 2011.

Clarke Stipulation

About a week before the hearing, our attorney, Stephanie Dzur (who prevailed in the single family residential property tax lightning cases in 2009), extended an offer to the county attorney’s office. The offer was an agreement that indicated we understood that the county assessor has been making decisions based on the information available at the time, and while we respected the difficult position she was in, we believed we would prevail at formal hearings, and as such, the county should agree to rolling back all of our pending protests to the 2009 values plus a 3% increase. As part of this offer, Mrs. Dzur shared with the county assessor our case, which we believed to be very strong.

Wednesday, December 15th, was our formal hearing for all remaining property tax protests for Bernalillo County. By Tuesday afternoon, we had been able to negotiate all of our pending cases down to the lowest values, subject only to the apartment cases that has experienced “tax lightning” or an increase of more than 3%.

Wednesday morning, I received a call from the assessor and she indicated that she wanted to meet with myself, the county attorney, and our attorney, Stephanie Dzur. The assessor indicated that based on how the formal board was ruling, she believed that apartments should not be treated differently, and although she intended to appeal some of the formal rulings, she was willing to resolve and sign off on the balance of cases if we could come to terms on a stipulated agreement.

Over the course of the morning, we modified the language of our original stipulation presented in our offer the week before.

Although we had an intellectual interest in pursuing the case through formal boards and a passion to put on our case, foremost in our minds was the issue of an appeal. The assessor had indicated that she was going to appeal the decision of the formal tax board, and similar to the property tax lighting cases of 2009, we were concerned that our client’s would be exposed to many years of property tax bills based on much higher amounts, until the legal system could provide a final and complete ruling.

By working through the stipulated agreement, you and our other clients would benefit from a lower property tax bill and a final decision that was not appealable. For each property that was subject to this agreement, I have already forwarded to you the stipulated agreement. The gist of it is that we agreed that the assessor interpreted the law based on the best information she had at the time, that the information was changing over time, and that we wanted our clients to benefit from that updated information by being treated the same as other the residential properties in 2010.

In the end, we believe we had the better hand, the better case, and that it led to the best possible outcome.

2011 and beyond

Many of our client have asked us what 2011 will hold, and to be candid, while I have many ideas as to what might come about with a new governor, a “refreshed” legislature, and an reelected assessor, I remain hopeful that they will have the courage to deal with this pressing issue head-on.

My largest concern for future years is the creeping of politics in the property tax system. In his autobiography, Former Governor King indicated that one of the many reasons he wanted the state constitution rewritten in the 1970’s was to push politics out of the property tax system. The laws that came out of that constitutional congress served our state well for over three decades, but all of that effort has been undone by recent laws. Until we repeal those laws, or modify our property tax system I remain concerned that politics and politicians will continue to provide uncertainty in our property tax system. That uncertainty translates to an opaque property tax system that will have an impact on all of our property values.

Fortunately, organizations like the Apartment Association of New Mexico and NAIOP are staying on top of these issues by meeting with our elected leaders to provide a better outcome. If you are not currently a member of both of these organizations, I would highly recommend signing up in 2011.

My apologies for the lengthy update, but I thought you might have an interest in the rest of the story. If you have an interest in copies of any of the above mentioned documents, don’t hesitate to let me know.

Thanks,

Todd

————————-

Todd Clarke CCIM

Cantera Consultants & Advisors Inc.

715 8th NW Albuquerque NM 87102

O 505-247-1411

M 505-440-TODD

F 800-791-4047

tclarke@nmapartment.com

www.nmapartment.com

Read Confessions of a Commercial Real Estate Consultant – www.toddclarke.com

————————-

NM Commercial Real Estate Value Survey

Cantera Consultants & Advisors has just released the results from our latest valuation survey. This survey was performed over the summer of 2010 with real estate owners, investors, lenders, brokers and appraisers.

The attached document demonstrates the changes in CAP rates and values from 2005 to 2010.

Click here for the survey results and a related newspaper article CCA-Survey-07092010-v8plusJournalArticle

Course: Understanding NM’s Property Tax System

Did you know at one time in NM’s history, your political affiliation impacted the amount of your property tax bill? Are you confused by Tax Lightening? Uncertain as to what surprises next year’s property tax bill will hold? Do you want to understand why it is “fair” for two similar properties to have different assessed values? Confused by the media news and the latest legislation? Need the straight scoop on the property tax law? Then plan to attend this course!

Learn how:

– To build a credible case for protesting your property’s tax value

– To calculate your property tax bill

– What you should provide and what you shouldn’t

– How the assessors in each county approach value

– The basis of the property tax law and how it impacts your tax bill

– How to conduct your negotiations at informal and formal hearings

– Includes a review of the latest legislative laws/updates

– Includes Fifth edition book “Understanding NM’s Property Tax system” a $50 value.

– Book includes case study and mock informal and formal hearings

– You will leave this course with the tools you need to file a protest

This course has been utilized by owners of property to lower their values as well as real estate professionals looking to understand the process and offer additional services to their clients. The course includes the 5th Edition, 360 page book titled “Understanding NM’s Property Tax System”, a $50 value, free of charge (PDF version is free, printed version is $50). This must-have text book includes sample case studies, and cites state statutes that are important to know for any settlement or formal hearing. (if you don’t need the CE and want the textbook – it can be ordered here: www.canteraconsultants.com/books)

Register for this or any other course at www.canteraconsultants.com/cca2015 .

Additional information about your international award winning instructor can be found at www.toddclarke.com

Property Tax update on 770 KKOB AM

![]()

Thanks to Bob Clark and 770 KKOB for hosting Stephanie Dzur and I last week.

We fielded dozens of calls about the property tax lightning and other property tax issues.

If you aren’t familiar with Stephanie’s name you should be. Stephanie is a local attorney won the case last year against the Bernalillo County assessor’s office that ended with the district court ruling that the law was unconstitutional.

In additional to winning the case, Stephanie was a home owner impacted by tax lightning. She maintains a blog on the issues that can be found here.

Later this week, a complete podcast of this radioshow wil be available on this website.

NM Notices of property tax value are being mailed out

Bernalillo County is mailng out notices of value on April 1st, 2010 and the deadline to file a protest of value will be 30 days after that.

The remaining 32 counties have indicated that this is there mailing schedule:

Our firm offers three options to assist you in property tax protests:

1. buy our 250+ page, fourth edition text book – click here to order for $49.

2. attend our “Understanding NM’s Property Tax System” course on April 15th, 2010 – you can register by clicking here.

3. hire our firm to represent you on a contigency basis – email tclarke@nmapartment.com or call 440-TODD (8633) for more info.

What to look for in a property tax consultant.

I recently assisted a client with finding a property tax consultant in Kansas. After using the CCIM network to identify candidates, we issued a brief RFP and identified the top contenders in a short time.

Experience

Experience should include not only how many protests have they successfully completed, but also the kind training and background in analysis and or appraisal for the given property type. Additionally, they should have other experience in your property classification/type. For instance, if they were involved in selling apartments and had access to all of the comparable sales, because many of were sales they had been involved in, then the power of their testimony in informal or formal hearings carries substantial more weight that someone who collected the sales info third-hand.

Approach

There are many approaches as to how a consultant works the protest, for example, some consultants use their political skills while others use their skills of analysis.

Results

Ask the consultant the following:

What are their results?

What was their toughest case?

What was their easiest case? (and did they charge for it?)

Who is their competition?

Have they had success getting a reduction after following competition?

As you interview property tax agents you should:

Ask to see copies of their most recent reports – a protestor who doesn’t file a report, is not likely to get you the lowest possible valuation.

Fully understand how their pricing for their services work – some have little incentive to do a thorough job to protest your taxes because they charge you a low monthly or annual fee to monitor your values.

Ask for a copy of their contract – make sure you understand how you pay them and when. For example, some tax consultants charge just for the first years savings while other charge you for every year that value remains in place (it would be better to pay a 35% contingency fee on only the first year savings, than pay a 25% contingency fee on two years savings which would effectively cost you 50% of the savings).

Ask for a summary report of their average track record for clients. Some tax consultant’s average as little as 8% average reductions, and others that are in the double digits. Don’t fall into the trap of being “sold” on their services when they tell you about their “best” case. For example, our firm lowered a valuation from $9M to $1M last year, an 89% reduction, which hardly represents our average of 24%.

Discuss with them the process and how hands on they are

Ask them what documentation they will need from you as owner. While it may be a chore to dig up old paperwork, if they don’t ask you for copies of old appraisals, surveys, and phase I environmental audits, then they are not likely to be extremely diligent in obtaining the lowest value.

Ask what experience the consultant has in your particular property niche – don’t for example, hire someone who specializes in office buildings and has never done a ministorage protest.

Ask for testimonial letters from former clients and request their contact info to follow-up.

If the tax consultant demands an upfront fee to analyze your property, move on! There are many other tax consultants who are glad to review your property and tell you if they think you have a case or not.

Beware of consultants who imply they have a political “in” with an assessor. The state of New Mexico Tax and Revenue department has an auditing process to smoke out cases that were settled without merit.

Ask for their resume and look for their additional experience in the market – a tax consultant who has been an active in the real estate community is likely to command more respect at a formal hearing, than an tax consultant who is a virtually an unknown entity in the market.

Remember – the person you hire is your advocate, if you don’t have warm fuzzy feelings with them, move on to the next tax consultant.

Fee models

Annual flat fee

Some firms, particularly national ones, charge a flat fee to review their client’s valuations and, when they deem necessary, protest them. They generally have no built-in incentive to protest and their compensation is not tied to the degree to which they prevail.

This model works well in states where the property tax owner and assessor often agree on the accurate value for the property.

Contingency fee

This arrangement gives the owner’s agent an incentive to protest, if they believe that they can win, and it makes their compensation proportionate to the reduction in value they achieve.

1. Analysis skill set

2. Additional services offered

3. Methodologies used

4. Since they get paid if the reduce the tax bill, will the consultant be willing to pay if they get the taxes raised?

As always, if you ever need assitance in finding a tax consultant, don’t hesitate to email or call me at (505) 440-TODD or tclarke@nmapartment.com

Apartments and Property tax lighting

Cantera Consultants & Advisors Inc. recently completed a thorough analysis of all apartments in Bernalillo County.

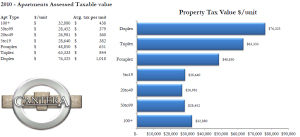

The following graph is a summary of that analysis.

The graph illustrates that duplexes, triplexes and fourplexes are assessed at a much higher rate than their bigger peers.

If you feel this is counter intuitive, you would be correct – generally, the newest nicest apartments with swimming pools, clubhouses and movie theaters are the larger apartments.

So whats going on in the details?

Simple – our property tax code is too complicated, and skewed towards the larger owner who can afford to higher a property tax consultant such as Cantera and the smaller owners are less likely to pay attention when their notice of values come out.

What can you do about this? Join advocacy groups like the Apartment Association of NM and work with there government affairs committee to help our legislature change our laws.

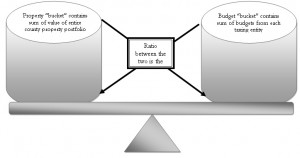

The potential impact of upcoming legislative and legal changes on NM’s Property Tax System

I think of our property tax system as a bit of a prisoner’s dilemma (that is the game theory where two suspects are picked up by the police – if they both refuse to cooperate they walk, if either turns on the other suspect, then other suspect goes to jail, and if they both turn in the other, they both go to jail). Applying that to our property tax system, I believe that most property owners want a fair system, but so long as there are loopholes or the perception of unfairness, than they too want that loop hole – the end game of which is a downward spiral in tax revenues.

Personally, I believe in supporting the person who has the right ideas over a party ideology– and former Governor King is just such a person – in the early 1970s he had the state constitution rewritten, in part to deal with the inequities in the property tax system (it was common for your political affiliation to dictate how high or low your property taxes are). So whenever I contemplate changes to the property tax law, I think, what would Gov. King look for that would create a fair equitable system.

Although our property tax system has a lot of “fairness” built into it, simple it isn’t. This flow chart shows how the property tax system works and who can influence it.

If I grossly simplify that process, there are four places to influence the final tax bill:

- The property value

- The % of that property value that is assessed (current 1/3)

- Deduction for any exemptions

- Mill levy (which is calculated by taking the total budget for taxing entities and dividing that by net taxable value for each county’s portfolio)

So simply said, our tax bill is calculated by taking:

Property value x % of assessment – allowed deductions = net taxable value x mill levy.

By having the law focus on only property value, it is possible to have no net change on the tax payers final properly tax bill. For example – if we had a law that said every property would double in value (say to reflect true market conditions) in 2010, then net impact on the tax bill would be no net change. (When you double the values, you halve the mill levy).

So in dealing with the two issues of tax lightning and fairness, my own personal belief is:

- At the time, (I was on a panel with him when he said this), the original intent of the Santa Fe assessor who wrote the some-what-disclosure & 3% cap law, he did so with the intent to protect the little old lady who has had the same house for 100+ years in Santa Fe – the idea was to keep her property taxes down even when the values were being pushed up by the Hollywood crowd moving into her neighborhood. This could have been handled through an exemption (like we do for Veterans and head of household, etc.), and we wouldn’t have the issues we do now. If the law was turned into the protecting the little old lady law through exemption, but it kept her property value

- I believe his true intent was to push through sales disclosure. The way the law was written, if an assessor disclosed information that had been disclosed to them, for every incident of disclosure, they were liable for a $1,000 fine, but the tax protest process requires the assessor to provide the protestant with complete copies of info (covered under part of the state statutes that deal with disclosure in court cases) – so I file a protest, the assessor uses 6 comparable sales that were disclosed to them by a property owner and that property owner could sue them for $6,000 – many of the 33 assessor’s were scared of this law and how to protect property info (I know of a county down south where you could “purchase” the assessor’s data set for a nominal amount of money).

- The 3% CAP was only supposed to protect the little old lady, not the average home owner, and certainly not the large apartment owner (22 counties consider apartments residential, 10 consider them commercial, and 1 just doesn’t know). BUT now that the law exists, I have been able to get my large apartment owners the same protection (no increase in value and a 3% CAP) – and as much as I love my industry, that just isn’t fair for our community.

- So looking at the law from every angle, there is no piece of the original legislation that provides transparency or disclosure.

- For residential, the law should be repealed entirely. The 3% CAP distorts everyone’s property taxes (when California passed proposition 13 (basically a limit on property tax increases), that state when from one of the best in schools and infrastructures to one of the worse.

- The commercial property owner and broker just isn’t paying attention – for example, let’s say you own a property in Rio Rancho – last year the residential property owners (who live in Sandoval County) voted to effectively double their mill rate by taxing themselves for a new college and hospital. The non-voting commercial property owner is now receiving a tax bill for $40,000 instead of $20,000 which has decreased their property value (in the short term at least) by $500,000 (8% CAP rate) or 20% of its original value of $2.5M.

- Furthermore, as the residential values decrease through the 3% CAP, the commercial property bears the burden of taxation. Although this next example is a different expense item, but it illustrates the unintended changes caused by new laws – in Florida, to reduce insurance costs, the legislature shifted more of the burden from residential to commercial – so much so that a 1,000 unit development project I worked on had a insurance bill as an apartment (commercial) that was 10 times higher ($2M) than if it was a condo (residential) which would have an insurance bill of $200,000. The Caps on increases of value for one property class will cause the same distortion.

- As it relates to newly developed properties – I have a client who tried to build a 300+ unit new construction apartment on Albuquerque’s Westside – its likely value was going to be lead to a tax bill that was 3.5 times higher than similar properties that had been built in previous years (which were subject to a CAP as well) – so the existing property owner had an unfair competitive advantage that caused this apartment not to be developed. To fix that, I think we would need a system where by new construction is phased in over 3 years to its full value AND we need a system that allows all property’s to be raised to their full value

- FAs it relates to bond issues, I believe when the voters vote, they need to understand that while their property taxes may (or may not) go up, by declining a bond issue, their property taxes could go down. Said another way if the ballot said “would you vote for a new library knowing that it would raise your property taxes by $40 a year for every $100,000 in value your house had (Y/N).” Then the tax payer/voter could consider the value the said public amenity (road, library, school, hospital, etc) adds to their community. Further consideration would have to be given to whether commercial benefits from every public service (fire/police= yes, library/school-no) and how we accommodate for that.

Finally, to have a fully fair and equitable process, any future laws need to model the impact on values based on the current mill levy, % of value, and property value and the outcome needs to be one where we can:

- Explain it to a new buyer or developer (for example – your property tax bill will likely be 1% of what you pay)

- Is transparent in operation (if I showed you the inequities in what we have now, and the loopholes that I as a tax consultant can use, you would be amazed at the lack of transparency)

- Is as fair as possible (i.e. you could look at your neighbor’s property tax bills and understand why they are similar (in value) or dissimilar (in exemption) as yours)

- Does it eliminate the abuse of unintended loophole as possible (when I was in China, they had a property tax that said you would only be taxed if your property was 100% complete – guess how many 40 story hi-rises I saw with an unfinished floor?)

An update on property tax legislation

From the RANM newsletter dated 3/10/2009

FROM THE NEW MEXICO LEGISLATURE

Property Tax Disclosure Bills

Another property tax disclosure bill has moved in the Senate the last ten days. SB 564 (Duran), originally introduced in the Senate at the request of RANM, would require the property owner to provide the written declaration obtained from the county assessor stating the estimated taxes after sale of the house and valuation at the new price. The bill passed the Senate yesterday and now goes to the House.

HB 261 (Sandoval), introduced in the House, requires the seller or seller’s broker to obtain the future tax declaration from the county assessor. This is the bill we have worked to amend so that brokers are protected from liability. It passed the House and now goes to the Senate. Each bill has sufficient protections for real estate brokers.

SB 181 and SB 333 Property Tax Bills

Thanks for the great response to the Call to Action last week. SB 181 (Boitano) passed the Senate Finance Committee March 3 after the Call to Action and is now on the floor of the Senate for action. The bill would protect residential property with the annual 3 percent cap even upon sale of the property.

SB 333 would lower the maximum percentage of an undeveloped property’s market value which can be taxed from 33 1/3 percent to 16 2/3 percent. It has been on the schedule of the Senate Finance Committee for five days, and may not move.

My own 2 cents…

Senate Bill 564 is a good idea except where it snags apartment buildings… (apartments are in a purgatory area, and the last thing a seller wants to do is disclose a sale that many counties don’t require be disclosed)

The remaining bills only add to the mess that was created with partial disclosure, and will eventually lead to much larger bills for all of us (they seem to forget, when you push down values, everyone’s values, the mill levy increases) – if the goal is to achieve equity in the system – this doesn’t do it.

OP-ED- Equity in Property Taxes

OP-EDEquity in property taxes

Todd Clarke CCIM

The Albuqueruqe Journal editorial titled “Add Equity to State’s CAP on Property Taxes” dated January 23, 2009 contains only part of the information needed to make an informed decision about making changes to the NM property tax system.

As always, there are unintended consequences of any piece of legislation, and in 2000 the desire to protect New Mexico’s most vulnerable citizens, those low income seniors, has ended up protecting some of New Mexico’s largest property owners.

As the editorial indicated, House Bill 366 was enacted into law in 2000, was pushed by the Santa Fe County Assessor to protect long time elderly home owners from rapid increases in values from neighboring sales to out of state buyers. The stealthier part of this legislation was to undo a 30 year ban on the disclosure of real estate sales information. It is important to note that his legislation only impacted the taxable value of the property, not the tax bill (i.e. if the taxable value increased by the cap of 3%, but the mill levy increased 200%, the property owner’s tax bill would more than double).